lu-st.online Gainers & Losers

Gainers & Losers

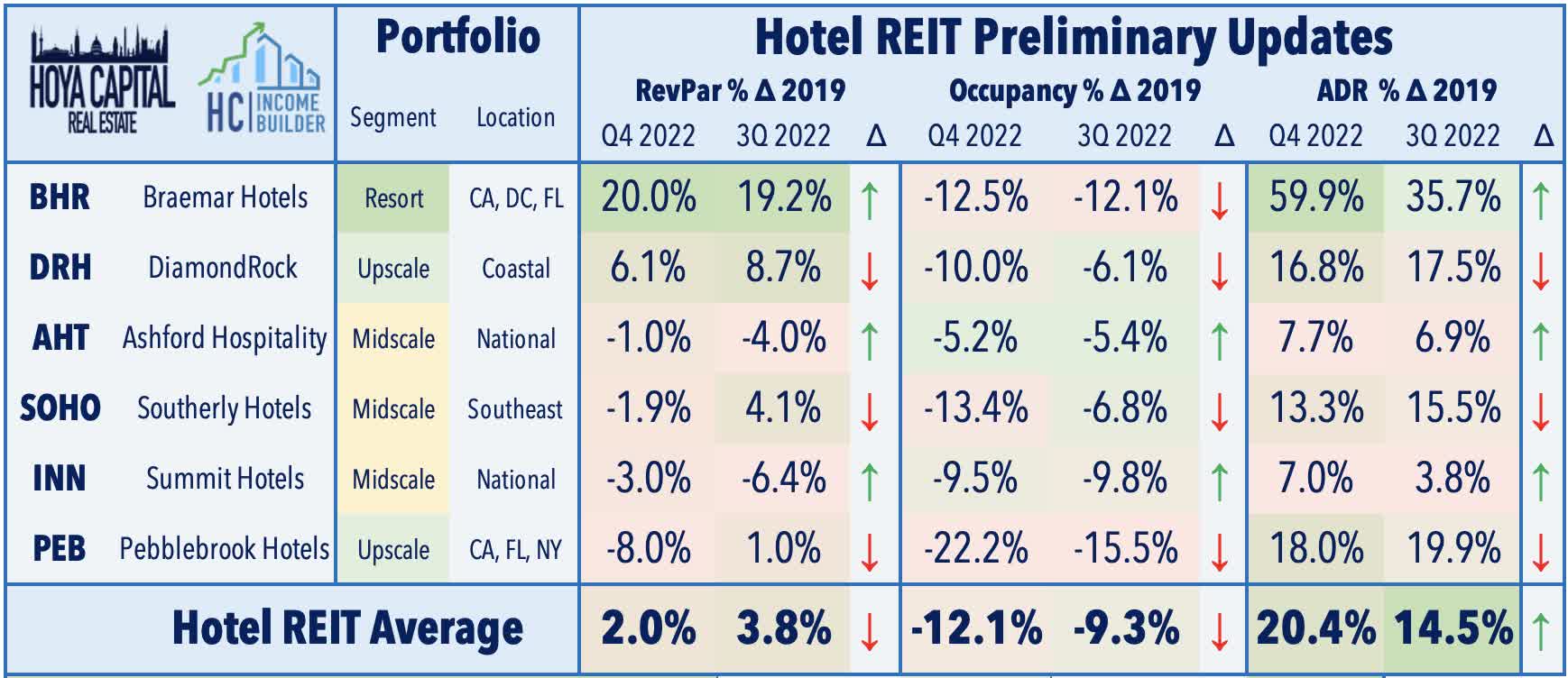

Hotel Reit Stocks

Apple Hospitality REIT, Inc. (NYSE: APLE) is a publicly traded real estate investment trust (REIT) that owns a portfolio of upscale, select service hotels. A real estate investment trust (REIT) focused on investing in luxury hotels and resorts · Recent News · Portfolio · Investor · Keep Up With The Latest News. Hospitality REITs offer a lower-cost option for investing in commercial real estate like hotels or resorts. Learn about the industry and your options for. Japan Hotel REIT Investment Corporation (TYO): Stock quote, stock chart, quotes, analysis, advice, financials and news for Stock Japan Hotel REIT. Japan Hotel Reit Investment Corp T-JP:Tokyo Stock Exchange · Open72, · Day High73, · Day Low72, · Prev Close72, · 52 Week High86, Singapore Exchange Listed Hotel & Resort REITs Real Estate Investment Trusts (S-REIT), Stapled Trusts with Target Price, Analyst Reports. The REIT - Hotel & Motel industry has a total of 16 stocks, with a combined market cap of $ billion, total revenue of $ billion and a weighted average. The REIT - Hotel & Motel industry is comprised of real estate investment trusts (REITs) that own and operate hotels and motels. These REITs typically own a. Lodging REITs own and manage hotels and resorts and rent space in those properties to guests. Lodging REITs own different classes of hotels based on. Apple Hospitality REIT, Inc. (NYSE: APLE) is a publicly traded real estate investment trust (REIT) that owns a portfolio of upscale, select service hotels. A real estate investment trust (REIT) focused on investing in luxury hotels and resorts · Recent News · Portfolio · Investor · Keep Up With The Latest News. Hospitality REITs offer a lower-cost option for investing in commercial real estate like hotels or resorts. Learn about the industry and your options for. Japan Hotel REIT Investment Corporation (TYO): Stock quote, stock chart, quotes, analysis, advice, financials and news for Stock Japan Hotel REIT. Japan Hotel Reit Investment Corp T-JP:Tokyo Stock Exchange · Open72, · Day High73, · Day Low72, · Prev Close72, · 52 Week High86, Singapore Exchange Listed Hotel & Resort REITs Real Estate Investment Trusts (S-REIT), Stapled Trusts with Target Price, Analyst Reports. The REIT - Hotel & Motel industry has a total of 16 stocks, with a combined market cap of $ billion, total revenue of $ billion and a weighted average. The REIT - Hotel & Motel industry is comprised of real estate investment trusts (REITs) that own and operate hotels and motels. These REITs typically own a. Lodging REITs own and manage hotels and resorts and rent space in those properties to guests. Lodging REITs own different classes of hotels based on.

Hospitality Investors Trust, Inc. is a real estate investment trust which owns a diversified portfolio of strategically-located hotel properties throughout. Ashford Hospitality Trust is a real estate investment trust (REIT) focused on investing predominantly in upper upscale, full-service hotels. Recent News. 7. Find More Stocks. Use our equities screener to discover other potential opportunities. Find Similar Stocks Find Stocks Similar to Apple Hospitality REIT, Inc. (NYSE: APLE) is a publicly traded real estate investment trust with a large portfolio of hotels such as Marriott and Hilton. REIT - Hotel/Motel ; RHP. Ryman Hospitality Properties, Inc. ; APLE. Apple Hospitality REIT, Inc. ; PK. Park Hotels & Resorts Inc. Procaccianti Hotel REIT, Inc. intends to acquire and own a diversified portfolio of hospitality properties consisting primarily of existing extended-stay. These trusts invest heavily in real estate and pay at least 90% of taxable income to shareholders. Hotel REITs focus specifically on hotel properties. If you. Investors interested in the Hotel and Lodging REITs sector may also consider the "Hospitality REITs ETF" (Ticker: STAY) as a viable option. STAY aims to track. Host Hotels is among the world's largest publicly traded lodging REIT, with 75+ hotels in its portfolio and presence in 20 top markets in the US. The company. The monthly stock returns of specific REIT property sectors will be analysed for the period from. January to December These data will be used to. 10 Biggest Hotel Companies and REITs · 1. Marriott International (MAR) · 2. MGM Resorts (MGM) · 3. Las Vegas Sands (LVS) · 4. Hilton Worldwide Holdings (HLT). REITs - Hotel is the # ranked industry out of , which means it is in the 6 percentile of all industries we cover. That percentile equates to a POWR. Dow Jones U.S. Hotel & Lodging REIT Index ; Day Range - ; 52 Week Range - ; 5 Day. % ; 1 Month. % ; 3 Month. %. Japan Hotel REIT Investment Corp. ; 52 Wk Range64, - 86, ; Volume, K ; Market Value, ¥B ; EPS (TTM), ¥2, ; P/E Ratio (TTM), Stock Quote American Hotel Income Properties REIT LP is traded on the Toronto Stock Exchange (TSX) in both Canadian and U.S. dollars. The Canadian denominated. Complete List of Real Estate - REITs - REIT - Hotel & Motel Stocks ; American Hotel Income Properties REIT LP (TSX:lu-st.online). C$ Canada ; Apple Hospitality. Japan Hotel REIT Investment Corp is a real estate investment trust. It aims to achieve stable earnings and sustainable growth in the asset from mid- to. The latest MORI TRUST Hotel Reit stock prices, stock quotes, news, and MOTHF history to help you invest and trade smarter. List Of REIT—Hotel & Motel Stocks ; Host Hotels & Resorts Inc · HST, B · , ; Ryman Hospitality Properties Inc · RHP, B · , Real-time Price Updates for American Hotel Income Properties REIT LP (HOT-UN-T), along with buy or sell indicators, analysis, charts, historical performance.

Home Buying Ratios

Debt Ratios For Residential Lending. Lenders use a ratio called "debt to income" to determine the most you can pay monthly after your other monthly debts are. According to the 28/36 rule, you should spend no more than 28% of your gross monthly income on housing and no more than 36% on all debts. Ideally, lenders prefer a debt-to-income ratio lower than 36%, with no more than 28%–35% of that debt going toward servicing a mortgage.1 The maximum DTI ratio. Calculating Your DTI Ratio As A Couple When buying a home, a mortgage is often shared by a couple, which means that the DTI gets calculated for the couple. Those percentages should be examined side-by-side with the debt-to-income requirements of a conventional home loan. In many cases the borrower gets only 28% of. LendingTree's home affordability calculator is set to a 28% DTI ratio, but you can slide the bar up to 50% to see how much more house you'd be able to buy if. Housing and debt ratios help you determine whether the home you want is also one that you can afford. Maximum DTI Ratios For manually underwritten loans, Fannie Mae's maximum total DTI ratio is 36% of the borrower's stable monthly income. The maximum can be. According to the Federal Deposit Insurance Corp., lenders typically want the front-end ratio to be no more than 25% to 28% of your monthly gross income. The. Debt Ratios For Residential Lending. Lenders use a ratio called "debt to income" to determine the most you can pay monthly after your other monthly debts are. According to the 28/36 rule, you should spend no more than 28% of your gross monthly income on housing and no more than 36% on all debts. Ideally, lenders prefer a debt-to-income ratio lower than 36%, with no more than 28%–35% of that debt going toward servicing a mortgage.1 The maximum DTI ratio. Calculating Your DTI Ratio As A Couple When buying a home, a mortgage is often shared by a couple, which means that the DTI gets calculated for the couple. Those percentages should be examined side-by-side with the debt-to-income requirements of a conventional home loan. In many cases the borrower gets only 28% of. LendingTree's home affordability calculator is set to a 28% DTI ratio, but you can slide the bar up to 50% to see how much more house you'd be able to buy if. Housing and debt ratios help you determine whether the home you want is also one that you can afford. Maximum DTI Ratios For manually underwritten loans, Fannie Mae's maximum total DTI ratio is 36% of the borrower's stable monthly income. The maximum can be. According to the Federal Deposit Insurance Corp., lenders typically want the front-end ratio to be no more than 25% to 28% of your monthly gross income. The.

Front-end debt ratio, sometimes called mortgage-to-income ratio in the context of home-buying, is computed by dividing total monthly housing costs by monthly. What is a debt-to-income ratio? · Mortgage principal and interest · Hazard insurance premium · Property taxes · Mortgage insurance premium (if applicable). Why Your DTI Is So Important · Front end ratio is a DTI calculation that includes all housing costs (mortgage or rent, private mortgage insurance, HOA fees, etc.). This allows you to qualify for a conforming mortgage. Early in the home-buying process, it would be best to ask various lenders about their requirements. If. According to a breakdown from The Mortgage Reports, a good debt-to-income ratio is 43% or less. Many lenders may even want to see a DTI that's closer to 35%. The front-end ratio is what percentage of your income would go towards housing expenses, and the back-end ratio includes the aforementioned along with other. Use our convenient calculator to figure your ratio. This information can help you decide how much money you can afford to borrow for a house or a new car. This calculation shows what percentage of your gross monthly income will go towards housing expenses. This includes mortgage payments, property taxes. By dividing all of your monthly liabilities (including the proposed housing payment) by your gross monthly income, they come up with a percentage. This key. Mortgage lenders use this ratio to help determine whether a home buyer qualifies for a mortgage loan. Lenders frequently use the housing expense ratio in. Lenders look at two ratios. The front-end ratio is the percentage of monthly before-tax earnings that are spent on house payments (including principal, interest. Step 1: Your debt-to-income ratio is calculated by adding up all your monthly debt · Monthly rent or house payment · Monthly alimony or child support payments. This calculation shows what percentage of your gross monthly income will go towards housing expenses. This includes mortgage payments, property taxes. By dividing all of your monthly liabilities (including the proposed housing payment) by your gross monthly income, they come up with a percentage. This key. In addition to lowering your overall debt, it's important to add as little, or no, new debt as possible during the homebuying process such as buying a car or. ratio, the better your chances are of qualifying for a mortgage lu-st.online: Home Purchase and Refinance Loans. FHA Loan Programs for The. In an ideal scenario, having a debt ratio under 36% can increase your chances of qualifying for a home loan even though we have approved loans woth ratios over. A debt-to-income ratio (DTI) is expressed as a percentage, showing how much of your total monthly income goes toward debt payments each month. The debt-to-income ratio surprises a lot of loan applicants who always thought of themselves as good money managers. Whether they want to buy a house.

Linkedin Advertising For Agencies

Intelus Agency is an award-winning LinkedIn ads agency helping B2B companies get a better ROI by reducing wasted ad spend and avoiding bad fit leads. Here is a list of the best LinkedIn marketing agencies that will help your brand stand out from the crowd. Buyer's guide to vetting the top U.S. LinkedIn marketing agencies for Learn how to choose the right agency and boost your lead generation on LinkedIn. Our B2B LinkedIn Ads Agency helps leading SaaS and Tech Businesses accelerate user acquisition through LinkedIn ads. Work with a small team of senior. LinkedIn, with its community of over million professionals, offers a unique platform for targeted advertising. Our Montreal-based LinkedIn advertising. Create easy and effective LinkedIn advertising. Whether your goal is to generate leads, increase brand awareness, or even promote event registrations, LinkedIn. Elevate your B2B marketing with LinkedIn's online advertising solutions. Target precisely, create impactful campaigns and measure results effortlessly. The top five Social Media Marketing companies specializing in LinkedIn Advertising are: Jives Media (5-stars and reviews); ExpandX (5-stars and 49 reviews). Our agency runs & manages high-performing LinkedIn ads campaigns to convert your prospects into clients. Book a free consultation to learn how we scale B2B. Intelus Agency is an award-winning LinkedIn ads agency helping B2B companies get a better ROI by reducing wasted ad spend and avoiding bad fit leads. Here is a list of the best LinkedIn marketing agencies that will help your brand stand out from the crowd. Buyer's guide to vetting the top U.S. LinkedIn marketing agencies for Learn how to choose the right agency and boost your lead generation on LinkedIn. Our B2B LinkedIn Ads Agency helps leading SaaS and Tech Businesses accelerate user acquisition through LinkedIn ads. Work with a small team of senior. LinkedIn, with its community of over million professionals, offers a unique platform for targeted advertising. Our Montreal-based LinkedIn advertising. Create easy and effective LinkedIn advertising. Whether your goal is to generate leads, increase brand awareness, or even promote event registrations, LinkedIn. Elevate your B2B marketing with LinkedIn's online advertising solutions. Target precisely, create impactful campaigns and measure results effortlessly. The top five Social Media Marketing companies specializing in LinkedIn Advertising are: Jives Media (5-stars and reviews); ExpandX (5-stars and 49 reviews). Our agency runs & manages high-performing LinkedIn ads campaigns to convert your prospects into clients. Book a free consultation to learn how we scale B2B.

Konstruct Digital is a LinkedIn ads agency that helps businesses create high-performing campaigns to generate more leads and maximize their ROI. Let's explore the world of LinkedIn advertising and discover the best LinkedIn advertising agencies to partner with for optimal results. We've found the best. LinkedIn Marketing Providers. for you. · BrandLume · Edkent Media · Major Tom · lu-st.online · BragDeal Inc. · GrowME Marketing · PraxisPR. Let's explore the world of LinkedIn advertising and discover the best LinkedIn advertising agencies to partner with for optimal results. 7 Best LinkedIn Advertising Agencies · 1. Impactable · 2. B2Linked · 3. Remotion · 4. Cleverly · 5. Intelus · 6. Zima Media · 7. Win at LinkedIn. Selecting the right LinkedIn marketing agency begins with understanding your objectives and ensuring the agency aligns with these ambitions. Our LinkedIn Advertising agency works with this platform to advertise for many industries. This includes e-commerce, health & beauty, wellness, and more. I'm the co-founder of Getuplead, a LinkedIn Ads agency specializing in SaaS and B2B tech companies. We are a small team of experts with extensive experience. In no order, here are the top LinkedIn marketing agencies who can help you generate leads and skyrocket your business. Trusted by 75+ brands, Fill My Funnel is the #1 B2B LinkedIn ads agency that turns advertisements into customers and consistently delivers results. We are one of the best LinkedIn Ads Agency partners offering LinkedIn Ads strategy and LinkedIn Ads campaign creation, we are also a full service agency. Campaign Manager is the all-in-one advertising platform on LinkedIn. You can set up ad accounts, run campaigns, and control your budget as soon as you sign in. We're not just a LinkedIn Ads agency; we're your LinkedIn Advertising partner. With over $M in ad spend under our belt, we know LinkedIn Ads inside out. Finally, get your LinkedIn Ads to work, with an agency that specializes in LinkedIn Ads for B2B SaaS. We have a proven process for generating pipeline. Boost your business with our LinkedIn Ads agency. At Speedwork Social, we specialize in LinkedIn advertising to help you reach professionals. We can help you achieve your LinkedIn objective of choice, whether it be to generate leads, drive website traffic, or build brand awareness. LinkedIn Marketing And Advertising Agency. Turn LinkedIn into a targeted lead generation machine with powerful paid advertising. The price of your LinkedIn advertising campaign all depends on your budget. Our management fee is 30% of this, and there is a one-time set–up fee as well. LinkedIn Advertising Agency Focused On ROI & Performance. Create Highly Targeted & Engaging LinkedIn Campaigns With Our LinkedIn Advertising Services. We are the best LinkedIn advertising agency that specializes in helping businesses transform their professional network and maximize their reach.

Does Full Coverage Car Insurance Cover Blown Engine

Comprehensive car insurance coverage covers non-collision-related damage to your vehicle from things like theft, fire, striking an animal or a tree falling on. Most types of physical damage to your car caused by an at-fault accident are typically covered if you have enhanced coverage like Collision or All Perils. However, no matter how much auto insurance coverage you carry, a damaged or blown engine won't be covered if the issue isn't related to a covered incident. Collision and comprehensive coverages can help pay for repairs to your car for covered losses like damage from hitting an object or flooding, and liability may. Blowing up your motor isn't covered by liability, collision or comprehensive insurance. You do get a warranty with every new car and warranties. An illustration of a person wearing a hooded sweatshirt in a circle over a car,. Comprehensive insurance coverage does not cover your vehicle from all types of. Whether it's routine maintenance, a mechanical failure or a blown engine, car insurance will most likely not cover the costs of repairing or replacing your. covered under the collision coverage or comprehensive coverage of the policy. If you are unsure whether a blown engine would be covered under your policy. No. Even if you have “full coverage” with Comprehensive and Collision, your car insurance won't pay for engine failure not caused by a covered claim. Comprehensive car insurance coverage covers non-collision-related damage to your vehicle from things like theft, fire, striking an animal or a tree falling on. Most types of physical damage to your car caused by an at-fault accident are typically covered if you have enhanced coverage like Collision or All Perils. However, no matter how much auto insurance coverage you carry, a damaged or blown engine won't be covered if the issue isn't related to a covered incident. Collision and comprehensive coverages can help pay for repairs to your car for covered losses like damage from hitting an object or flooding, and liability may. Blowing up your motor isn't covered by liability, collision or comprehensive insurance. You do get a warranty with every new car and warranties. An illustration of a person wearing a hooded sweatshirt in a circle over a car,. Comprehensive insurance coverage does not cover your vehicle from all types of. Whether it's routine maintenance, a mechanical failure or a blown engine, car insurance will most likely not cover the costs of repairing or replacing your. covered under the collision coverage or comprehensive coverage of the policy. If you are unsure whether a blown engine would be covered under your policy. No. Even if you have “full coverage” with Comprehensive and Collision, your car insurance won't pay for engine failure not caused by a covered claim.

It also covers windshield damage and damage from hitting an animal. However, it does not cover normal wear and tear or engine failure. When deciding whether. No worries though—if you have comprehensive coverage, it will cover the repair cost minus your deductible. Scenario #2: You go out of town to visit a friend for. Nationwide car insurance can cover you for accidents involving other vehicles, vandalism, weather, animals, bodily injuries and more. A blown engine that's the result of a mechanical failure or wear and tear won't be covered by comprehensive or collision coverage. Generally, no. A typical car insurance policy only covers repairs if they're related to an accident. You likely won't be covered if your engine simply has a. However, no matter how much auto insurance coverage you carry, a damaged or blown engine won't be covered if the issue isn't related to a covered incident. No worries though—if you have comprehensive coverage, it will cover the repair cost minus your deductible. Scenario #2: You go out of town to visit a friend for. Comprehensive coverage helps pay to repair or replace a covered vehicle from a loss not caused by a collision. Collision and comprehensive coverages can help pay for repairs to your car for covered losses like damage from hitting an object or flooding, and liability may. Comprehensive is coverage for damage to your vehicle. It covers your vehicle in the event of a theft or vandalism. It can also help with losses resulting from. Yes, comprehensive coverage is designed to handle this sort of claim (partial fire), assuming there is no exclusion outlined in your policy to. Comprehensive coverage helps cover the cost of damages to your vehicle when you're involved in an accident that's not caused by a collision. Liability coverage is typically included in all auto insurance policies, as it's required by law in most states. Bodily injury liability coverage helps pay for. Comprehensive insurance covers you when things besides a car accident damage your car, such as a falling tree branch, a break-in or hail damage from a storm. Ans: No. A car insurance policy does not cover mechanical or electrical failure of the engine thus it won't cover such damage. To claim for such damages, a. It does not cover mechanical problems with your car. However, your policy may include roadside assistance and towing in the event of a break-. Comprehensive coverage covers damage to your vehicle caused by weather, theft, animals, vandalism or other non-collision events. How much does auto insurance. Comprehensive insurance covers you when things besides a car accident damage your car, such as a falling tree branch, a break-in or hail damage from a storm. Gap insurance is designed to cover the difference between your car's value and what you owe on it in the event of a total loss. · If you're concerned about. Comprehensive coverage covers damage to your vehicle caused by weather, theft, animals, vandalism or other non-collision events. How much does auto insurance.