lu-st.online Gainers & Losers

Gainers & Losers

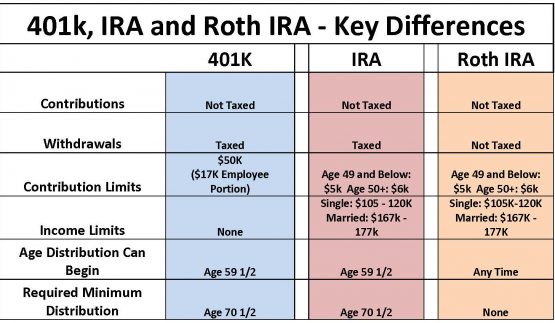

Best After Tax Retirement Account

A good example of an after-tax retirement account would be a Roth IRA. What tax professional who can help you design a strategy that's best for you. Roth IRA or Roth (k) qualified distributions are tax-free. Social Security income is taxed at your ordinary income rate up to 85% of your benefits; the. Tax advantages. IRAs offer significant tax advantages, including tax-deferred growth on traditional IRAs and tax-free withdrawals in retirement for Roth IRAs. Contribute to a (k). · Contribute to a Roth (k). · Contribute to an IRA. · Contribute to a Roth IRA. · Make catch-up contributions. · Take advantage of the. Another little-known strategy allows high earners to use after-tax contributions to a (k) to fund a Roth IRA. It's called a mega backdoor Roth. One of the key benefits of aftertax (k) contributions is that they are allowable on top of the basic traditional or Roth contributions, making them ideal for. Your retirement plan lets you contribute money either on a pretax basis or through the after-tax Roth option. So what's the difference? An after-tax (k) account can offer a convenient, yet disciplined way to create a designated emergency fund at your workplace. This fund can be used to cover. Your money grows tax-deferred in a traditional IRA. When you withdraw the money after retiring, it is taxed at your ordinary income tax rate for that year. A good example of an after-tax retirement account would be a Roth IRA. What tax professional who can help you design a strategy that's best for you. Roth IRA or Roth (k) qualified distributions are tax-free. Social Security income is taxed at your ordinary income rate up to 85% of your benefits; the. Tax advantages. IRAs offer significant tax advantages, including tax-deferred growth on traditional IRAs and tax-free withdrawals in retirement for Roth IRAs. Contribute to a (k). · Contribute to a Roth (k). · Contribute to an IRA. · Contribute to a Roth IRA. · Make catch-up contributions. · Take advantage of the. Another little-known strategy allows high earners to use after-tax contributions to a (k) to fund a Roth IRA. It's called a mega backdoor Roth. One of the key benefits of aftertax (k) contributions is that they are allowable on top of the basic traditional or Roth contributions, making them ideal for. Your retirement plan lets you contribute money either on a pretax basis or through the after-tax Roth option. So what's the difference? An after-tax (k) account can offer a convenient, yet disciplined way to create a designated emergency fund at your workplace. This fund can be used to cover. Your money grows tax-deferred in a traditional IRA. When you withdraw the money after retiring, it is taxed at your ordinary income tax rate for that year.

Unless you plan to live extremely frugally in retirement, you'll need to supplement this income. One option is to find part-time work after retirement. Retirees. Learn how much you may need to retire, how tax-advantaged retirement accounts work, and more. best things you can do for your future self. Here's why. Who's this Roth IRA option best for? · Individuals who expect to be in a higher tax bracket when taking withdrawals · Individuals who don't need a deduction on. Work-Related Retirement Savings Options · Employer-sponsored retirement plan. · Often includes employer matching contributions. · Pre-tax. Tax-advantaged savings accounts like traditional or Roth IRA and (k)s are among the best retirement plans to build your nest egg. Roth and traditional. You can work after Full Retirement Age and earn as much as you'd like Pensions from government jobs or jobs worked abroad without paying Social Security taxes. After-tax contributions are also a great option for those who need to withdraw funds before age 59 1/2 and don't have a Roth retirement account. Traditional The tax treatment of after-tax contributions comes with a catch. Unlike with Roth contributions, your withdrawals during retirement aren't completely tax-free. With a Roth IRA, you contribute after-tax dollars and can't deduct contributions from your taxes. But any investment gains the account makes are yours in. great way to help employees save for retirement while also trimming your business' tax bill. Learn how Roth (k) plans and after-tax contributions help. retirement on a tax-deferred basis as employees participating in company plans IRA plan for the year as soon as administratively feasible after your. That means you contribute to a Roth IRA using after-tax dollars and pay no taxes, even on your investment gains. Also, Roth IRAs do not have required minimum. Unlike tax-deferred accounts, contributions to Roth (k)s and Roth IRAs are made with after-tax dollars, so they won't reduce your current taxable income. But. In , the IRS limit for pretax and/or Roth after-tax contributions is $23, (including contributions made to a (k) through a previous employer). Appealing to Both Employee & Employer. A (k) account is a sought-after employee benefit that allows participants to contribute a portion of their wages on a. You can roll over after-tax contributions to a Roth IRA, and it is possible to do that before age 59½. There is a big catch though: Not all plans allow. Distributions in retirement are taxed as ordinary income. A Roth withdrawal will be tax free if the withdrawal is made 5 years or more after January 1 of the. Roth retirement accounts. The Roth option allows you to contribute money without reducing your taxable income. These are referred to as after-tax contributions. If you meet the phased-out modified adjusted gross income limits, which are based on your federal tax filing status, a Roth IRA may be a good choice for you. Save beyond your workplace plan and take advantage of tax benefits with a Roth or Traditional IRA. We can help you find the option that's right for you.

529 Plan Requirements

:max_bytes(150000):strip_icc()/529-plan-contribution-limits-2016.asp_Final-28fe6ce80ec7400fb9e62e35624d8c2b.jpg)

A plan is a tax-advantaged account made specifically for education savings—like colleges, trade schools, and vocational schools. You can save for your child. Section plans are offered by states under the federal tax code and may provide significant tax advantages to parents and others who save for future higher. Most plans do not have residency requirements. For example, you do not have to be a Virginia resident to open an Invest account (except the Tuition Track. savings plans are one of the most popular education savings account types in the US. They let you save for education and enjoy other benefits too. High maximums: Contribute up to a total of $, per beneficiary for accounts in all Plans sponsored by the State of Montana. Competitive Fees and. Start an education fund for your children or a family member with a Schwab Education Savings Plan. You can open and contribute to almost any plan. First, you can use a plan to pay for off-campus and non university-managed accommodation as long as the beneficiary is enrolled in an eligible college. Participation Requirements – All U.S. residents, 18 and over, can open and fund a plan, regardless of income level. Typically, a parent or grandparent. plans must be 15 years old to be eligible for Roth transfer: The plan must have been maintained for a minimum of 15 years to be eligible for transfer. A plan is a tax-advantaged account made specifically for education savings—like colleges, trade schools, and vocational schools. You can save for your child. Section plans are offered by states under the federal tax code and may provide significant tax advantages to parents and others who save for future higher. Most plans do not have residency requirements. For example, you do not have to be a Virginia resident to open an Invest account (except the Tuition Track. savings plans are one of the most popular education savings account types in the US. They let you save for education and enjoy other benefits too. High maximums: Contribute up to a total of $, per beneficiary for accounts in all Plans sponsored by the State of Montana. Competitive Fees and. Start an education fund for your children or a family member with a Schwab Education Savings Plan. You can open and contribute to almost any plan. First, you can use a plan to pay for off-campus and non university-managed accommodation as long as the beneficiary is enrolled in an eligible college. Participation Requirements – All U.S. residents, 18 and over, can open and fund a plan, regardless of income level. Typically, a parent or grandparent. plans must be 15 years old to be eligible for Roth transfer: The plan must have been maintained for a minimum of 15 years to be eligible for transfer.

The availability of such tax or other benefits may be conditioned on meeting certain requirements. When you invest in a college savings plan. You can even open a plan for yourself. Qualified education expenses include tuition and fees, books, room and board, computers, and more. The funds can. All plans help investors save for educational goals, but they're not all the same. Use our tool below to determine if TIAA manages the plan in your. A savings plan works in some respects like a Roth retirement savings plan. This kind of allows account holders to open an account and invest after-tax. Typically, you can contribute up to $18, a year (or $36, for couples) to one or more college savings plans without incurring the gift tax. But it's. investment growth is tax-free, so even while your investments may grow, you won't have to pay taxes when used for qualified education expenses. Many states. Some plans require a minimum deposit to open a account, and many require each deposit to be of a certain size. More and more plans, however, are starting to. When you invest in a plan, you pay money into an investment account on behalf of a designated beneficiary—often your child, but any U.S. citizen or resident. Your college savings plan can cover much more than tuition. You can withdraw the funds to pay for room and board, textbooks, and other university fees. What. A college savings plan is a state-sponsored investment plan that enables you to save money for a beneficiary and pay for education expenses. A plan is a college savings plan sponsored by a state or state agency. Savings can be used for tuition, books, and other qualified expenses at most. To qualify as a plan under federal rules, a state program must not accept contributions in excess of the anticipated cost of a beneficiary's qualified. requirements and limitations. Please review the requirements and College Savings Plan. Read it carefully before investing. You should. Welcome to Ohio's tax-free Direct Plan. This is the simple, flexible way to save for whatever school comes after high school. Who can invest in a Plan? The Education Plan is offered to any U.S. resident no matter where they live in the U.S. Any U.S. citizen or resident with a valid. Typically, a plan does not require the child to attend college immediately after graduating high school. In general, if the child decides not to go to. The account has to have been open for at least 15 years. The beneficiary of both the account and the Roth IRA must be same person. The amount of. However, most plans don't require you to use a broker — you can go the DIY route and potentially save thousands of dollars setting up the account yourself. For more information about the ScholarShare College Savings Plan, call We want accessibility for all Parents and grandparents to save for their education goals. No Age, Income Requirements. Unlike many other savings options.

How Far Back Does A Live Scan Background Check Go

How many years does a Level 2 background check go back in Florida? There are no time limits on how far back an employer in Florida can check into an. Florida has no laws that limit how far back an employer can look into a candidate's past regarding criminal convictions. However, the state does abide by. After 90 days, the FBI deletes the fingerprint background check transactions and considers the FBI background check request complete. The applicant has to be. This requirement does not apply to background checks completed within the last ninety (90) days. (c) Background checks are required for all staff at least every. Under California law, commercially prepared background checks cannot report arrests not leading to a conviction unless the company has verified in the last Turnaround time is seven business days or less. Responses are returned to the requesting employer or licensing agency indicated on the RI Live Scan. Background check may reveal an arrest from 15 years ago. Access to criminal records database through fingerprint-based checks allows this data. The Automated Background Check Management System (ABCMS) launched September 29, and can be found at this link. DCDEE has developed a user guide that you. How far back does a criminal background check go in California? In California, employment background checks go back for the prior seven years. 7. What is the. How many years does a Level 2 background check go back in Florida? There are no time limits on how far back an employer in Florida can check into an. Florida has no laws that limit how far back an employer can look into a candidate's past regarding criminal convictions. However, the state does abide by. After 90 days, the FBI deletes the fingerprint background check transactions and considers the FBI background check request complete. The applicant has to be. This requirement does not apply to background checks completed within the last ninety (90) days. (c) Background checks are required for all staff at least every. Under California law, commercially prepared background checks cannot report arrests not leading to a conviction unless the company has verified in the last Turnaround time is seven business days or less. Responses are returned to the requesting employer or licensing agency indicated on the RI Live Scan. Background check may reveal an arrest from 15 years ago. Access to criminal records database through fingerprint-based checks allows this data. The Automated Background Check Management System (ABCMS) launched September 29, and can be found at this link. DCDEE has developed a user guide that you. How far back does a criminal background check go in California? In California, employment background checks go back for the prior seven years. 7. What is the.

If you're wondering how many years of a criminal record are reviewed with Live scan fingerprinting. Then it searched the preceding 7 years of. live fingerprint scan at this website. The applicant can choose the date The online criminal background check does not include the Child Maltreatment Registry. Arkansas Live Scan is an Arkansas Based company specializing in digital fingerprint scanning. Our process greatly shortens turnaround time for the types of. A: A fingerprint background check is required by the university's Protection of Minors policy. If you do not go through the Live Scan fingerprint process, you. Yes, criminal background checks are provided for the last 7 years when you use a legitimate background screening company like AAA Credit. Q: How many years back do you look for convictions? A: Lifetime, regardless of age (excludes juvenile adjudications), the length of time that has passed. Turnaround time is seven business days or less. Responses are returned to the requesting employer or licensing agency indicated on the RI Live Scan. Fingerprint Hard Cards If you live outside of California and cannot access a Live Scan site in this State, you need to complete your criminal history. FDLE will only re-send the results back to the State agency at their own request within a period of six months. After this time frame, neither Accurate. The IHSS program requires all providers be fingerprinted via Live Scan to complete a criminal background check through the State of California Department. This relatively new technology allows criminal background checks to be processed usually within 72 hours. This livescan technology is sometimes referred to as. You cannot remove a conviction from a Live Scan background check without receiving an expungement, pardon, or record sealing with only one exception. The. For most routine background checks conducted by the FBI, the scope typically goes back seven to ten years. This period is commonly referred to as the "look-back. The Hawaii Criminal Justice Data Center (HCJDC) provides background checks based upon fingerprints for the State of Hawaii only* and fingerprint digital/ink. In rare instances, fingerprint quality may be too low to register for the FBI Rapback. USBE will contact the individual to make a 2nd submission for prints. If. live for Next Generation Identification (NGI) Rap Back Service. background checks must be done electronically via approved live scan fingerprinting units. live fingerprint scan at this website. The applicant can choose the date The online criminal background check does not include the Child Maltreatment Registry. Private background check companies can't report arrests or other adverse information that is more than seven years old unless the report concerns employment of. going to the live scan vendor. Out of State Fingerprint Background Checks. All fingerprint transactions must be submitted to ISP electronically through a. Florida has no laws that limit how far back an employer can look into a candidate's past regarding criminal convictions. However, the state does abide by.

New Growing Stocks

Best growth stocks ; Salesforce (CRM). Salesforce (CRM) · $B ; Applied Materials (AMAT). Applied Materials (AMAT) · $B ; Vertex Pharmaceuticals (VRTX). Best growth stocks · Salesforce (CRM). · Applied Materials (AMAT). · Vertex Pharmaceuticals (VRTX). · KLA (KLAC). · PayPal (PYPL). Best growth stocks · Salesforce (CRM). · Applied Materials (AMAT). · Vertex Pharmaceuticals (VRTX). · KLA (KLAC). · PayPal (PYPL). They might be leaders in their market niche or highly competitive firms in their industry. They may benefit from major outside factors such as new legislation. Top growth stocks in ; Tesla (NASDAQ:TSLA), 31%, Automotive ; Shopify (NYSE:SHOP), 24%, E-commerce ; Block (NYSE:SQ), 13%, Digital payments ; Etsy (NASDAQ:ETSY). The fund's primary risk, apart from general stock market volatility, comes from the fact that its focus on large-capitalization growth stocks may, at times. FAST GROWING STOCK · 1. Bajaj Holdings, , , , , , , , , , , · 2. Lloyds Metals, Growth Stocks · 1. C P C L, , , , , , , , , , · 2. Prism Finance, , , , Seeking Alpha's latest contributor opinion and analysis for investors interested in growth stocks. Click to discover stock ideas, strategies, and analysis. Best growth stocks ; Salesforce (CRM). Salesforce (CRM) · $B ; Applied Materials (AMAT). Applied Materials (AMAT) · $B ; Vertex Pharmaceuticals (VRTX). Best growth stocks · Salesforce (CRM). · Applied Materials (AMAT). · Vertex Pharmaceuticals (VRTX). · KLA (KLAC). · PayPal (PYPL). Best growth stocks · Salesforce (CRM). · Applied Materials (AMAT). · Vertex Pharmaceuticals (VRTX). · KLA (KLAC). · PayPal (PYPL). They might be leaders in their market niche or highly competitive firms in their industry. They may benefit from major outside factors such as new legislation. Top growth stocks in ; Tesla (NASDAQ:TSLA), 31%, Automotive ; Shopify (NYSE:SHOP), 24%, E-commerce ; Block (NYSE:SQ), 13%, Digital payments ; Etsy (NASDAQ:ETSY). The fund's primary risk, apart from general stock market volatility, comes from the fact that its focus on large-capitalization growth stocks may, at times. FAST GROWING STOCK · 1. Bajaj Holdings, , , , , , , , , , , · 2. Lloyds Metals, Growth Stocks · 1. C P C L, , , , , , , , , , · 2. Prism Finance, , , , Seeking Alpha's latest contributor opinion and analysis for investors interested in growth stocks. Click to discover stock ideas, strategies, and analysis.

The market seems to be playing a new tune. When the music is playing we must get up and dance. The market seems to be playing a new tune. When the music is playing we must get up and dance. When it comes to cheap stocks to buy, you'll likely have more success when you screen for good fundamentals, technicals and fund sponsorship. Growth Technology Stocks ; NVDA. NVIDIA Corporation, ; QRVO. Qorvo, Inc. ; NOVA. Sunnova Energy International Inc. ; YMM. Top growth stocks in ; Tesla (NASDAQ:TSLA), 31%, Automotive ; Shopify (NYSE:SHOP), 24%, E-commerce ; Block (NYSE:SQ), 13%, Digital payments ; Etsy (NASDAQ:ETSY). FAST GROWING STOCK · 1. Bajaj Holdings, , , , , , , , , , , · 2. Lloyds Metals, Growth stocks are shares of companies that are expected to grow sales and earnings at a faster rate than the market or industry average. Learn more. That's right, you can buy shares of the New York Stock Exchange Some stocks to buy on the list are high-valued fast-growing companies, while others are under. A growth stock is any share in a company that is anticipated to grow at a rate significantly above the average growth for the market. These stocks generally do. Secular growth stocks in the technology and consumer sectors are generally 30 to 50% off their 52 week highs, which combined with growth in. Growth stocks are made up of companies that are set to grow their earnings and revenue by an abundant amount compared to the rest of the market, which also has. When we consider a specific growth stock, we start by putting all the important information we know about the company into perspective. That new invention may. Growth stocks are one option for investors looking to buy into companies Are entering or developing a new market or niche; Develop or spearhead a. You can look at stocks making new week highs, any financial website can provide that list. Filter these down by metrics like revenue/profit growth, ROE and. Companies that deal with technology, technological advances, or are constantly putting out new hardware, software, and devices are good picks for growth. Any growth stocks you can point in my direction? Current footprint is the South/Southeast US, but they are opening new stores and have room to. New York Stock Exchange (typically 4 p.m., Eastern time). The returns shown The chance that returns from large-capitalization growth stocks will trail returns. We selected the 12 best growth stocks above based on the highest day percentage return, among those listed on the Nasdaq or New York Stock Exchange. Growth stocks are stocks that come with a substantially higher growth rate compared to the mean growth rate prevailing in the market. It means that the stock. Seeks opportunities in traditional growth stocks as well as cyclical The New Geography of Investing ®. Equity Portion Breakdown by Domicile.

Top Dining Credit Cards

The Chase Sapphire Preferred® Card and American Express® Gold Card are two great cards for earning points on takeout and delivery. As a note, most restaurant. Best Dining Credit Card Promotions in Singapore ; Up to 30% off at restaurants at Marina Bay Sands and Les Amis Group's restaurants. A Closer Look at the Best Cards for Dining Out · Best for Travel Rewards: Chase Sapphire Preferred · Best for Restaurants and U.S. Supermarkets: American. Chase Sapphire Reserve The Chase Sapphire Reserve offers 3 points per dollar on dining, and like the Amex Gold, extends that bonus beyond the borders of the. Best credit cards for restaurants of September · + Show Summary · Citi Custom Cash® Card · Capital One SavorOne Cash Rewards Credit Card · Chase Sapphire. The Hilton Honors American Express credit cards are a great way to earn Points for stays, status upgrades, and free stays! Compare each to find the perfect. Best credit cards for restaurants of August · + Show Summary · Citi Custom Cash® Card · Capital One SavorOne Cash Rewards Credit Card · Chase Sapphire. Top Credit Card Links Top Credit Card Links. Credit Card Home · Application credit towards travel and dining purchases; 0% † Intro APR for your first. Discover U.S. News' picks for the best travel rewards credit cards. Compare types of travel rewards credit cards and learn expert strategies to maximize. The Chase Sapphire Preferred® Card and American Express® Gold Card are two great cards for earning points on takeout and delivery. As a note, most restaurant. Best Dining Credit Card Promotions in Singapore ; Up to 30% off at restaurants at Marina Bay Sands and Les Amis Group's restaurants. A Closer Look at the Best Cards for Dining Out · Best for Travel Rewards: Chase Sapphire Preferred · Best for Restaurants and U.S. Supermarkets: American. Chase Sapphire Reserve The Chase Sapphire Reserve offers 3 points per dollar on dining, and like the Amex Gold, extends that bonus beyond the borders of the. Best credit cards for restaurants of September · + Show Summary · Citi Custom Cash® Card · Capital One SavorOne Cash Rewards Credit Card · Chase Sapphire. The Hilton Honors American Express credit cards are a great way to earn Points for stays, status upgrades, and free stays! Compare each to find the perfect. Best credit cards for restaurants of August · + Show Summary · Citi Custom Cash® Card · Capital One SavorOne Cash Rewards Credit Card · Chase Sapphire. Top Credit Card Links Top Credit Card Links. Credit Card Home · Application credit towards travel and dining purchases; 0% † Intro APR for your first. Discover U.S. News' picks for the best travel rewards credit cards. Compare types of travel rewards credit cards and learn expert strategies to maximize.

Earn more rewards with a World of Hyatt Credit Card ; Earn 2 Bonus Points per $1 spent on dining, airline tickets purchased directly from the airline, gym. Learn more about Marriott Bonvoy Boundless® Credit Card from Chase. Marriott Bonvoy Boundless® Credit Card from Chase · Learn more about Marriott Bonvoy Bold™. Citi Professional Card with ThankYou Network gives you 3 ThankYou Points per dollar spent at restaurants. Citi Professional Cash Card gives you 3% cash back on. Best credit card dining in person · US Bank Altitude Go: This card offers 4% cash back on dining and has no annual fee. · Redstone Credit Card. Find the best dining credit card for you, to earn dining rewards and cash back. Compare and apply for the best credit card for dining out. Best Dining Credit Cards of August · Citi Double Cash® Card · Citi Double Cash® Card · Chase Freedom Unlimited® · Best in Airline and Rewards Credit Cards. Plus, earn 5% cash back on travel purchased through Chase Travel SM, 3% on dining and drugstores, and 1% on all other purchases. APR. 0% intro APR for 15 months. Best Credit Cards for Restaurants · Discover it® Miles · Citi Strata Premier℠ Card · Capital One Venture Rewards Credit Card · Citi Custom Cash Card · Citi Double. Capital One QuicksilverOne Cash Rewards Credit Card ; N/A* · %-5% (cash back) · % (Variable) · $ Earn up to $ back annually on eligible Resy purchases using your enrolled Delta Skymiles® Reserve American Express Card. Terms apply. VIEW DETAILS. GDA. The best credit cards for restaurants in · Chase Sapphire Preferred® Card · Citi Strata Premier℠ Card · American Express® Green Card · Capital One Venture. Best credit cards for restaurants and dining · Best for earning travel rewards: American Express® Gold Card · Best for flexible bonus categories: Citi Custom. Best Credit Cards for Restaurants · Discover it® Miles · Citi Strata Premier℠ Card · Capital One Venture Rewards Credit Card · Citi Custom Cash Card · Citi Double. American Express Cards. Personal Cards. Jump to Business. Best for restaurants. * Eligible cards include US-issued, Capital One branded, rewards-earning consumer and small business credit cards. Capital One debit cards, private label retail. The American Express ® Gold Card stands out for its robust rewards, especially for food enthusiasts. It offers 4X points on dining worldwide (up to $50, per. best. OPTION 1. 3% cash back. on gas and EV charging Earn unlimited points—3x on travel purchases, 2x on dining, and 1x on all other eligible purchases. Earn points on all purchases and spend them on the best experiences in your city and beyond. Past member favourites. BAO restaurant food on display. The Chase Sapphire Preferred® Card and American Express® Gold Card are two great cards for earning points on takeout and delivery. As a note, most restaurant. Credit Cards and Food Delivery: What Are the Rules on Reward Rates? · Credit cards and their food-delivery reward rules · Amazon's Prime Visa · American Express®.

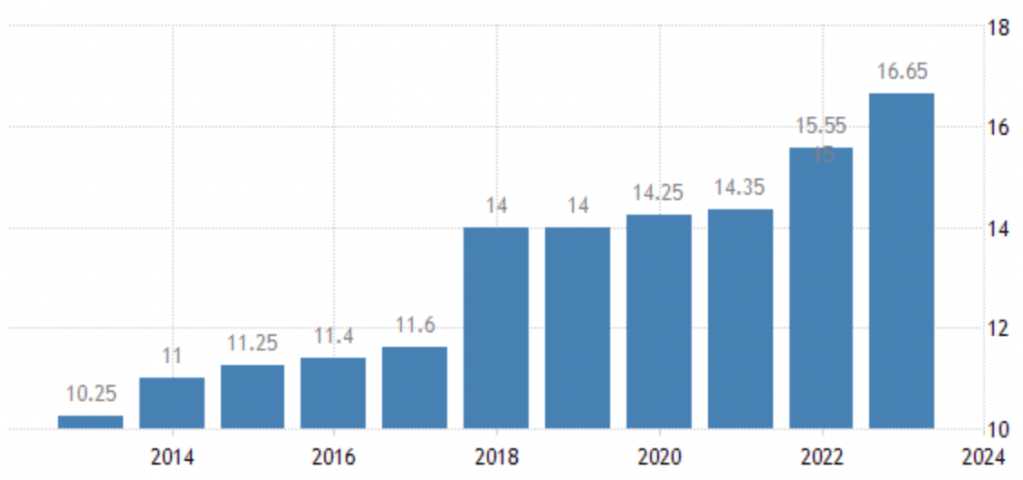

Minimum Wage In Ontario

Ontario's minimum wage is set to increase to $ an hour on October 1, While this is technically a raise for those at the very bottom of the wage scale. ACORN Canada is calling on Ontario Premier Kathleen Wynne to raise the minimum wage to $14 an hour and index future increases to the cost of living. On January 1, , minimum wage across Ontario increased to $15 per hour — a victory won as a result of over a decade of tireless work led by workers. All minimum wage rates in Ontario are set to increase on October 1, The increase is tied to the Ontario Consumer Price Index and is intended to provide. Ontario. 6, 6, 6, 6, 6, 7, 7, 7, 8, 8, 9,50 10,25 10,25 10,25 10,25 11,00 11,25 11,40 11,60 14,00 14,00 14,25 15,00 15,50 16, EFFECTIVE OCTOBER 1, - ONTARIO MINIMUM WAGE - $/HR (for most commodities). / SAWP LMIA APPLICATIONS MUST STATE AT LEAST $/HR (for. Check Ontario Minimum Wage Canada Ontario will increase its wage from $ to $ per hour For 16, 17, 18, 19, 20, 21 Years Old. Table of Minimum Wage Rates ; Ontario, $, $ October 1, ; Québec, $ (Tipped Employees $) ; New Brunswick, $ ; Nova Scotia, $ Minimum wage rate by province/territory ; Ontario (home workers), $, October 1, , October 1, ; Ontario (general) · $, October 1, , October 1. Ontario's minimum wage is set to increase to $ an hour on October 1, While this is technically a raise for those at the very bottom of the wage scale. ACORN Canada is calling on Ontario Premier Kathleen Wynne to raise the minimum wage to $14 an hour and index future increases to the cost of living. On January 1, , minimum wage across Ontario increased to $15 per hour — a victory won as a result of over a decade of tireless work led by workers. All minimum wage rates in Ontario are set to increase on October 1, The increase is tied to the Ontario Consumer Price Index and is intended to provide. Ontario. 6, 6, 6, 6, 6, 7, 7, 7, 8, 8, 9,50 10,25 10,25 10,25 10,25 11,00 11,25 11,40 11,60 14,00 14,00 14,25 15,00 15,50 16, EFFECTIVE OCTOBER 1, - ONTARIO MINIMUM WAGE - $/HR (for most commodities). / SAWP LMIA APPLICATIONS MUST STATE AT LEAST $/HR (for. Check Ontario Minimum Wage Canada Ontario will increase its wage from $ to $ per hour For 16, 17, 18, 19, 20, 21 Years Old. Table of Minimum Wage Rates ; Ontario, $, $ October 1, ; Québec, $ (Tipped Employees $) ; New Brunswick, $ ; Nova Scotia, $ Minimum wage rate by province/territory ; Ontario (home workers), $, October 1, , October 1, ; Ontario (general) · $, October 1, , October 1.

Ontario Minimum Wage Increases. On Oct. 1, Ontario's minimum wage, the lowest wage employers are permitted to pay their workers per hour, rose from $ Ontario Minimum Wage videos and latest news articles; lu-st.online your source for the latest news on Ontario Minimum Wage. Ontario increased its minimum salary wage from $ to $ per hour, effective from October 1, The minimum wage is increasing from $ per hour to $ on Oct. 1, which brings Ontario's minimum wage to the second highest in Canada after British. Minimum Wages in Canada increased to CAD/Hour in from CAD/Hour in This page provides - Canada Minimum Wages- actual values. The minimum wage in California, effective January 1, , is $/hour for all employers. Fast Food Restaurant employers, effective April 1, , and. Oregon workers must make minimum wage. · $ per hour - Portland metro · $ per hour - Standard · $ per hour - Non-urban. Ontario. Ontario's minimum wage is currently $, effective Oct. 1, New rates, effective Oct. 1, will be published by April. By: Quinn Brown On March 28, , the Ontario government announced that the general minimum wage will increase to $ an hour (from $ On April 1 st, , the Federal minimum wage was increased from $ to $ per hour. For those working in provinces or territories where the general. What is the minimum wage in Ontario? Currently, the general wage rate is $ per hour. Ask Employer Line to prepare you for next year's increase. The Ontario Government has raised the rates to a new minimum wage. This raise had caused a rift in the media and many workplaces. This calculator provides an overview of the annual minimum wage for workers in Ontario excluding the compensation of days off and holidays. The province announced in that it would be boosting the minimum wage from $ to $15 in January It was further bumped from $15 to $ in. The general minimum wage in Ontario is currently $ per hour. Some jobs have separate rates. There is also a growing "living wage" movement in Canada. This. Minimum wage levels by jurisdiction ; Nova Scotia, , April 1, ; Nunavut, , January 1, ; Ontario · , October 1, ; Prince Edward Island. On the minimum wage, Ford once again follows Wynne's lead. The Ontario government plans to increase the minimum wage to $15 in January. Ontario Minimum Wage Raise Schedule: The general minimum wage in Ontario went up from $ to $ on October 1, , which is just 20 cents. The general minimum wage in Ontario is currently $ per hour. The student minimum wage is $ per hour. In Ontario, the government did away with server minimum wage, and now servers are paid the current adult minimum wage of Recently, a bar.

Data Privacy Versus Data Security

Data security and data privacy are intertwined concepts but focus on different dimensions of information management. Summary: Cybersecurity, or information security, refers to the measures taken to protect a computer or computer system against unauthorized access from a. Data privacy defines who has access to data, while data protection provides tools and policies to actually restrict access to the data. Compliance regulations. Data Security vs. Data Privacy Data security and data privacy both involve protecting data, but they are different. Data security entails controlling access. Everything around data protection, investigation etc. is own by Security, as an extension of our normal activities. As examples, we encrypt PII. Data security is about protecting data from unauthorized access—malicious and otherwise. Data privacy, on the other hand, is about which users are authorized. HIPAA is focused on the protection of healthcare-related personal data in the U.S., while the GDPR imposes a broader set of privacy standards. Data privacy transcends mere compliance; it is fundamental to individual freedom and security in the digital age. In the digital world, security generally refers to the unauthorized access of data, often involving protection against hackers or cyber criminals. Privacy. Data security and data privacy are intertwined concepts but focus on different dimensions of information management. Summary: Cybersecurity, or information security, refers to the measures taken to protect a computer or computer system against unauthorized access from a. Data privacy defines who has access to data, while data protection provides tools and policies to actually restrict access to the data. Compliance regulations. Data Security vs. Data Privacy Data security and data privacy both involve protecting data, but they are different. Data security entails controlling access. Everything around data protection, investigation etc. is own by Security, as an extension of our normal activities. As examples, we encrypt PII. Data security is about protecting data from unauthorized access—malicious and otherwise. Data privacy, on the other hand, is about which users are authorized. HIPAA is focused on the protection of healthcare-related personal data in the U.S., while the GDPR imposes a broader set of privacy standards. Data privacy transcends mere compliance; it is fundamental to individual freedom and security in the digital age. In the digital world, security generally refers to the unauthorized access of data, often involving protection against hackers or cyber criminals. Privacy.

Data privacy is focused on the use and governance of personal data—things like putting policies in place to ensure that consumers' personal information is. Encrypt all sensitive data. Data should be encrypted both at rest and in transit to ensure its protection. You can protect data as it's being transmitted with. Data confidentiality is often considered the same as data security. But beyond the foundational system and organisational safeguards, confidentiality is focused. Data privacy or information privacy is a branch of data security concerned with the proper handling of data – consent, notice, and regulatory obligations. More. Data security/protection is about protecting data from compromise by external attackers and malicious insiders whereas data privacy governs how the data is. Data security is vital for preventing data breaches and cyber-attacks, whereas data privacy is essential for maintaining the confidentiality and protecting. Data privacy is an area of protection that deals with handling confidential, personal, and sensitive data. Data security protects data of any kind against loss, manipulation and other threats and can be achieved in particular by technical and/or organisational. According to ISO , security protects assets from unauthorized persons, while data protection restricts access to critical data and resources. Data privacy ensures that personal data is handled appropriately, while data security provides the technical and operational safeguards to protect that data. The focus of protective measures when designing data security policies is on preventing unwanted access to data. The difference between privacy. Data protection is the mechanism that enforces the policies and regulations into motion and prevents unauthorized access or use. Data security involves using physical and logical strategies to protect information from data breaches, cyberattacks, and accidental or intentional data loss. Data security deals primarily with external threats while data privacy involves internal governance of data usage and sharing. While many different industries. Data protection is a subset of cybersecurity. While data protection focuses on ensuring data integrity, cybersecurity takes a broader approach by focusing on. The difference between security and privacy is that security is concerned with protecting data from malicious threats, whereas privacy is. Data privacy is how organizations handle customer data and the relevant regulations and rights. On the other hand, data security is the security practices that. Data Security vs Data Privacy: What's the Difference? · With data security, lower the risk of data being exposed. Data breaches can create a lot of damage. ·. Data protection refers to the mechanism of making copies of your data to restore in the event of a loss or corruption. · Whereas, data security. Data privacy vs. data security · Data privacy focuses on issues related to collecting, storing and retaining data as well as data transfers within applicable.

Best Insurance Plans For Mental Health

Each plan's carrier provides access to behavioral health services. Based on your plan, find the mental health and substance use disorder (SUD) treatment. Explore PlansWe're here to offer you the best plan possible for your family Mental Health Insights · Health Equity Research · Privacy Policy · Terms. All individual and family ACA plans sold through the Health Insurance Marketplace and directly from insurers cover mental health benefits, including therapy. Blue Shield of CA offers both employer and individual & family HMO and PPO health insurance plans for every budget, as well as dental and vision coverage. To help meet this growing demand, Manulife's Flexcare® Health and Dental Plans offer a mental health benefit to help cover the cost of treatment from a variety. Guaranteed issue life insurance: Guaranteed issue life insurance might be one of the best life insurance options for those with mental health conditions to. Learn about your insurance plan's mental health and substance use benefits such as confidential therapy, substance use treatments, and recovery specialists. The federal parity law requires insurance companies to treat mental and behavioral health and substance use disorder coverage equal to (or better than) medical. Learn how your health plan covers behavioral and mental health services. It's important to know you can't be denied coverage or charged more. Each plan's carrier provides access to behavioral health services. Based on your plan, find the mental health and substance use disorder (SUD) treatment. Explore PlansWe're here to offer you the best plan possible for your family Mental Health Insights · Health Equity Research · Privacy Policy · Terms. All individual and family ACA plans sold through the Health Insurance Marketplace and directly from insurers cover mental health benefits, including therapy. Blue Shield of CA offers both employer and individual & family HMO and PPO health insurance plans for every budget, as well as dental and vision coverage. To help meet this growing demand, Manulife's Flexcare® Health and Dental Plans offer a mental health benefit to help cover the cost of treatment from a variety. Guaranteed issue life insurance: Guaranteed issue life insurance might be one of the best life insurance options for those with mental health conditions to. Learn about your insurance plan's mental health and substance use benefits such as confidential therapy, substance use treatments, and recovery specialists. The federal parity law requires insurance companies to treat mental and behavioral health and substance use disorder coverage equal to (or better than) medical. Learn how your health plan covers behavioral and mental health services. It's important to know you can't be denied coverage or charged more.

Blue Cross Blue Shield (BCBS) is a national private insurance carrier that offers a full range of physical health and mental health services. As long as the. List of Mental Health Insurance Plans in India ; National Mediclaim Plus Plan, 90 days to 65 years, 2 lakh to 50 lakh ; New India Assurance Yuva Bharat Plan, disorder services under health insurance or benefit plans that provide medical/surgical benefits. The most recent law, the Mental Health Parity and. best short term health insurance plan you can is the right solution for you. mental illness claims experience, medical history, genetic information or health. Mental health and behavioral health programs and resources are available to help you feel better and help you get back to being you. Best for Health Management Programs: Oscar · Best for Customer Satisfaction: Kaiser Permanente · Largest Provider Network: Blue Cross Blue Shield · Best for “. Your HealthSelectSM medical plan includes benefits and resources to support your mental health. Your coverage includes care for many mental health concerns. best financial option for me from my employer-offered health insurance plans. mental health coverage, etc). I have gobs of medical expenses. Large group plans must follow the mental health parity requirements as mandated by the federal Mental Health Parity and Addition Equity Act (MHPAEA). The MHPAEA. Anthem health plans include coverage for doctor visits, hospital care, and mental health benefits, plus: health insurance plan that's the best option for you. The following information provides an overview for consumers and providers on mental health parity law. Parity laws prohibit health plans from being more. Mental health and substance use disorder services, including behavioral health treatment (this includes counseling and psychotherapy); Prescription drugs. Kaiser Permanente is the best health insurance company if you're shopping for coverage through the Health Insurance Marketplace. Feel your best, inside and out · Mental health coverage is available. · Get behavioral health support in 3 steps · Manage your behavioral health benefits through. Medicare does not cover a broad range of community-based services for people with mental illness. Who's Eligible? People aged 65 or older; Adults with. Insurance coverage for mental health, including autism Services, and substance use disorder benefits is critical to ensuring consumers can access and afford. Browse our plans to see the best option for you. Health Health insurance also helps you stay healthy through wellness programs and other benefits. Not all health plans provide coverage for treating mental health and other behavioral health needs. We care. © UCLA Health Top. How UCLA Health. Your medical insurance may offer behavioral health benefits, which cover treatment and visits with a psychiatrist, psychologist or other mental health. Accepted Medicaid Insurance Providers Offering Mental Health Coverage: · Amerigroup Georgia – GA Medicaid · Beacon Health Options – Georgia Collaborative ASO.

How Much Cost To Rewire A House

The cost to rewire a house ranges between $12, and $20,, or an average of $16, Rewiring costs are typically priced per square foot, with the average. How Much Does It Cost to Rewire a House? The cost of rewiring a house depends on the size of the house and the current electrical system in place. However, for. The cost to rewire a sq. ft. house typically ranges from $8, to $15,, depending on factors like the complexity of the job and your. The ultimate guide to calculating the cost to Rewire a House. Average cost is $, although it depends on many factors. The cost to rewire a house can be between $ and $2, Simple rewiring projects can be cheaper, but expect to pay $6, to rewire the entirety of an older. A licensed electrical contractor knows when it is necessary to obtain a permit, and which permits are needed for your project. The permit will cost the same. How Much Does It Cost to Rewire a House? The average cost to rewire a house goes anywhere between $1, to $10, or $2-$4 per square foot. However, most. Cost To Rewire a House · For homeowners, rewiring a home is crucial since it assures the security of electrical equipment and appliances. · The Average Cost of. Average Cost to Rewire a House. The average cost to rewire a house in is $7, However, the cost can range from as low as $1, to as high as $13, The cost to rewire a house ranges between $12, and $20,, or an average of $16, Rewiring costs are typically priced per square foot, with the average. How Much Does It Cost to Rewire a House? The cost of rewiring a house depends on the size of the house and the current electrical system in place. However, for. The cost to rewire a sq. ft. house typically ranges from $8, to $15,, depending on factors like the complexity of the job and your. The ultimate guide to calculating the cost to Rewire a House. Average cost is $, although it depends on many factors. The cost to rewire a house can be between $ and $2, Simple rewiring projects can be cheaper, but expect to pay $6, to rewire the entirety of an older. A licensed electrical contractor knows when it is necessary to obtain a permit, and which permits are needed for your project. The permit will cost the same. How Much Does It Cost to Rewire a House? The average cost to rewire a house goes anywhere between $1, to $10, or $2-$4 per square foot. However, most. Cost To Rewire a House · For homeowners, rewiring a home is crucial since it assures the security of electrical equipment and appliances. · The Average Cost of. Average Cost to Rewire a House. The average cost to rewire a house in is $7, However, the cost can range from as low as $1, to as high as $13,

HomeRewire Costs To Rewire. If you're wondering, “How much does house rewiring cost?”, we've outlined the average cost of a rewire below. Unoccupied Homes. 1. If you opt to get new wiring for your home, you should expect to pay between $ and $ per square foot. If you're wiring a new house or rewiring an old. Unfortunately, most homes that need to be rewired also need to upgrade their main electrical panel. Why? Well, in most cases, an older home that needs rewiring. Wire cost alone would be around $ Permits and inspections around $ depending where you are. Labour is going to be in the hundreds. Average Cost to Rewire a House. The average cost to rewire a house is between $8 and $12 a square foot. In electrical rewiring, all the current wires are. Rewiring a sq. ft. house usually costs between $6, and $12,, depending on the complexity and local rates. Hope that helps you out! If. The estimated cost range to install wires into your new home will probably be around $3 to $5 per square foot. Newly constructed homes will result in new wiring. Cost to Rewire a House? | HedgeHog Electric In these cases, the main question on homeowners' minds is, “How much does an average home rewiring cost?”. Partial rewiring involves updating specific circuits or areas of the house, such as the kitchen or bathroom. In contrast, complete rewiring involves replacing. To give you a general idea, rewiring a house in the Tampa Bay area, including locations like New Port Richey, Spring Hill, Hudson, and Brooksville, typically. If you suspect the wiring in your home may need updating, you are likely wondering about the cost to rewire a house. According to Angie's List, the average cost. The cost of having electrical wiring replaced in a 2, square foot home can vary significantly depending on the size and age of the home, as well as the. In April the cost to Re-Wire a Home starts at $8, - $10, per residence. Use our Cost Calculator for cost estimate examples customized to the location. Rewiring a house will usually take 1 to 2 days, the length of time will depend on a number of factors including the size of the home, and also the amount of. Rewiring a house will usually take 1 to 2 days, the length of time will depend on a number of factors including the size of the home, and also the amount of. How Much Does It Cost To Rewire a House? The cost of rewiring a house depends on square footage and how easy or difficult it is to access the space, but on. The cost of completely rewiring your Pratt, Kansas home could range in the hundreds or thousands of dollars. Estimates for these projects vary significantly. An average cost of rewiring a house is around $ – $ for a regular household. This price includes the materials, labor and the necessary permits. There isn't a fixed cost to rewire a home. However, we can provide a range based on the size of a home. Below is a ballpark figure for moderate pricing. Average total cost (materials and labor) for rewiring a house starts around $3,$8, for a moderate-sized home with easy access (at least inches of.

Memorandums Of Understanding

A MEMORANDUM OF UNDERSTANDING should be used when you submit a request for application involving a collaborative partner(s). A memorandum of understanding (MOU) is a written agreement between parties that expresses their aligned will. A memorandum of understanding (MOU) is an agreement between two or more parties/institutions. MOUs are not legally binding, but serve to document each. Memorandums of Understanding, City-Wide Pay Schedule, Part-Time Employees, Paso Robles Police Association, Paso Robles Professional Firefighters Service. Access the current City of Napa Contract Agreement or Memorandum of Understanding (MOU). Documents Napa City Employees' Association (NCEA). International Memorandum of Understanding (MOU). A non-binding international MOU is a general statement of mutual interest to explore opportunities for. Memoranda of Understanding (MOUs) explain how two or more agencies will cooperate and interact when their enforcement responsibilities overlap. Memorandum of Understanding Between The National Taxpayer Advocate and the Commissioner, Wage & Investment. Memorandums of Understanding (MOU), to address multi-organization coordination and communications. Overv ew and Background. Page 6. 2. Purpose. How To Use Th s. A MEMORANDUM OF UNDERSTANDING should be used when you submit a request for application involving a collaborative partner(s). A memorandum of understanding (MOU) is a written agreement between parties that expresses their aligned will. A memorandum of understanding (MOU) is an agreement between two or more parties/institutions. MOUs are not legally binding, but serve to document each. Memorandums of Understanding, City-Wide Pay Schedule, Part-Time Employees, Paso Robles Police Association, Paso Robles Professional Firefighters Service. Access the current City of Napa Contract Agreement or Memorandum of Understanding (MOU). Documents Napa City Employees' Association (NCEA). International Memorandum of Understanding (MOU). A non-binding international MOU is a general statement of mutual interest to explore opportunities for. Memoranda of Understanding (MOUs) explain how two or more agencies will cooperate and interact when their enforcement responsibilities overlap. Memorandum of Understanding Between The National Taxpayer Advocate and the Commissioner, Wage & Investment. Memorandums of Understanding (MOU), to address multi-organization coordination and communications. Overv ew and Background. Page 6. 2. Purpose. How To Use Th s.

Memorandum of Understanding. Between the U.S. Department of Justice and U.S. Department of Labor. I. Purpose and Scope. The U.S. Department of Labor (“DOL. Memorandum of Understanding between the U.S. Department of Labor, Offices of Federal Contract Compliance Programs (OFCCP) and Labor-Management Standards (OLMS). Our partners often ask us to explain the difference between a contract and a memorandum of understanding (MOU). Although there can be legal distinctions. Penn State uses three types of agreements for international collaborations- a Letter of Intent (LOI), a Memorandum of Understanding (MOU), and a Memorandum of. A memorandum of understanding, or MOU, is a nonbinding agreement that states each party's intentions to take action, conduct a business transaction, or form a. Interagency Memoranda of Understanding (MOUs). Local Law 40 of requires agencies to post certain memoranda of understanding and similar agreements ("MOUs"). Signing of the US-Portugal Memorandum of Understanding to establish a month pilot program to build intercultural understanding and provide training. Memoranda of Understanding (MOU). FSIS routinely collaborates with other Federal agencies, States, tribal authorities, stakeholders, and the public to ensure. A Memorandum of Understanding (MOU) is a signed non-obligating and legally non-binding document that describes the intentions, roles and responsibilities of. What are contracts and memoranda of agreement? When might you use each document? How do you read and understand a contract or memorandum of agreement? A memorandum of understanding (MOU) is a legal document describing a bilateral agreement between parties. It expresses a convergence of will between the parties. This MOU seeks to improve the relevance, clarity, accuracy, and consistency of OFCCP's contractor education and compliance tools and resources. THIS Memorandum of Understanding (“MOU”) is made by and between the New York State. Department of Financial Services (“DFS”) and the New York State Energy. Memorandums of Understanding are agreements reached between the city and each of the various employee bargaining units in the city. Memorandum of Understanding. Between the U.S. Department of Justice and U.S. Department of Labor. I. Purpose and Scope. The U.S. Department of Labor (“DOL. Memorandum of Understanding (MOU) between the United States Department of the Interior Office of Aviation Services and Teton County, Wyoming. Memorandum of Understanding or Agreement Definitions: A type of intra-agency, interagency, or National Guard agreement between two or more parties, which. A memorandum of understanding is an agreement between two or more parties. Learn how MOUs work, what's required and how they are related to contracts. International Memorandum of Understanding (MOU). A non-binding international MOU is a general statement of mutual interest to explore opportunities for. A memorandum of understanding, or MOU, is defined as an agreement between parties and can be bilateral (two) or multilateral (more than two parties). The MOU.