lu-st.online Recently Added

Recently Added

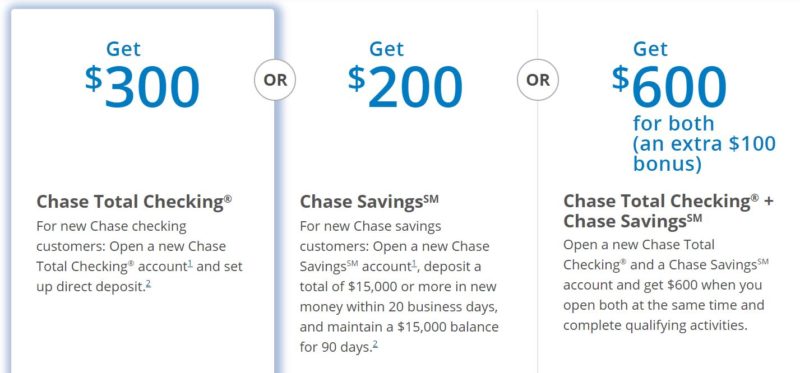

Chase Account Cost

Money order: $5 per check. All of the above fees are waived for Sapphire Checking customers. Premier Plus Checking customers get the cashier's check and money. Chase savings accounts only pay %–% APY—that's lower than the national average, and significantly less than the best high-yield savings accounts. $25 Monthly Service Fee Footnote(Opens Overlay) OR $0 with one of the following each monthly statement period: An average beginning day balance of $15, or. $5 per Withdrawal and $2 for any Transfers or Inquiries at ATMs outside the U.S., Puerto Rico and the U.S. Virgin Islands, plus any fees the ATM owner charges. Account Fees: Monthly Service Fee — $0 or $12, Overdraft Fees — $34, ATM Fees at Chase ATMs — $0, ATM Fees at Non-Chase ATMs — $3 to $5. Chase Bank is the consumer banking arm of JPMorgan Chase, one of the largest banking companies in the U.S. Chase offers banking services that include checking. Account Fees · Monthly Service Fee — $0 or $25 · ATM Fees at Chase ATMs — $0 · ATM Fees at Non-Chase ATMs — $0. To waive the fee on the Chase Total Checking, you need $ direct deposit each month OR $1, balance sitting in the account each day OR. Otherwise a $ Monthly Service Fee will apply. New and converted accounts will not be charged a Monthly Service Fee for at least the first two statement. Money order: $5 per check. All of the above fees are waived for Sapphire Checking customers. Premier Plus Checking customers get the cashier's check and money. Chase savings accounts only pay %–% APY—that's lower than the national average, and significantly less than the best high-yield savings accounts. $25 Monthly Service Fee Footnote(Opens Overlay) OR $0 with one of the following each monthly statement period: An average beginning day balance of $15, or. $5 per Withdrawal and $2 for any Transfers or Inquiries at ATMs outside the U.S., Puerto Rico and the U.S. Virgin Islands, plus any fees the ATM owner charges. Account Fees: Monthly Service Fee — $0 or $12, Overdraft Fees — $34, ATM Fees at Chase ATMs — $0, ATM Fees at Non-Chase ATMs — $3 to $5. Chase Bank is the consumer banking arm of JPMorgan Chase, one of the largest banking companies in the U.S. Chase offers banking services that include checking. Account Fees · Monthly Service Fee — $0 or $25 · ATM Fees at Chase ATMs — $0 · ATM Fees at Non-Chase ATMs — $0. To waive the fee on the Chase Total Checking, you need $ direct deposit each month OR $1, balance sitting in the account each day OR. Otherwise a $ Monthly Service Fee will apply. New and converted accounts will not be charged a Monthly Service Fee for at least the first two statement.

2 Subject to applicable transfer fees. Bank of America –. Rewards Savings Account –. Monthly Fee of $8 per month, or no fee if. Early direct deposit: This service comes with your Chase Secure Checking account in which we credit your eligible direct deposit transaction up to two business. Insufficient Funds Fee. $34 for each item we pay (maximum 3 Insufficient Funds and Returned Item Fees per day). We will not charge an Insufficient Funds Fee if. No fee for Chase design checks when ordered through Chase. No fee for counter checks, money orders and cashier's checks. No Chase fee on 4 non-Chase ATM. The Chase Total Checking® account has a monthly service fee of $12, but you may qualify for a fee waiver. Aside from child and student accounts, Chase doesn't. $12 monthly service fee Footnote(Opens Overlay) OR $0 with one of the following each monthly statement period: Electronic deposits made into this account. Chase Bank charges a $12 monthly fee on Chase Total Checking accounts. You can avoid the fee on your Chase Total Checking account if any one of. Here are a few tips to help avoid certain fees · Stay on top of your spending with the Chase Mobile® app · Set up alerts · Pay friends with Zelle. Chase Sapphire Checking. The monthly service fee for a Chase Sapphire Checking account is $25 and it's harder to waive than the other monthly Chase banking fees. Our most popular checking account. It offers several ways to get the $12 Monthly Service Fee waived, including with a qualifying direct deposit each statement. Account Fees · Monthly Service Fee — $0 or $ · ATM Fees at Non-Chase ATMs — $3 to $5. Helpful tip. There is a $15 Monthly Service Fee (MSF) that we'll waive if you meet any of the below qualifying activities for each Chase Business Complete Checking® account. Other fees · Stop Payment – $30 per request · Online or Automated Phone Stop Payment – $25 per request · Deposited Item Returned or Cashed Check Returned – $ Chase offers three kinds of business checking accounts. None requires a minimum opening deposit. Each features unlimited electronic deposits. Chase charges a. Chase Total Checking. Chase Bank charges a $12 monthly fee on Chase Total Checking accounts. You can avoid the fee on your Chase Total Checking account if any. Other fees · Stop Payment – $30 per request · Online or Automated Phone Stop Payment – $25 per request · Deposited Item Returned or Cashed Check Returned – $ Both have a minimum APY of %. However, you can earn an additional percentage point on the Chase Premier Savings account if you link a Chase Premier. Here are a few tips to help avoid certain fees · Stay on top of your spending with the Chase Mobile® app · Set up alerts · Pay friends with Zelle. After that, a $ fee per transaction is charged — but only on deposits and withdrawals made with a teller, and paper checks written on your account. No fee. $12 monthly service fee; No Monthly Service Fee while in school up to the graduation date provided at account opening (five years maximum) for students

Best Motorcycle Insurance Virginia

Compare and evaluate the cheapest motorcycle insurance in Virginia. Rankings are based exclusively on ratings and reviews from customers like you. Motorcycle Insurance for Gretna and all of Virginia Motorcycle Insurance from multiple insurance carriers so you can get the best possible rate. Best Motorcycle Insurance in Virginia · Elephant Insurance · The General Insurance · National General Insurance · Esurance · Erie Insurance · Virginia Farm. If you own a motorcycle, you need motorcycle insurance to protect you on the road. We will make sure that you have the right coverage at the best price. Peng's Insurance Agency represents many top-rated companies. We shop to find you the best Virginia Motorcycle Insurance value. () You can get a discount on your motorcycle insurance if we also handle your auto insurance policy. · If you have moving violations or tickets on your car driving. Get a free Dairyland® quote for Virginia motorcycle insurance. Dairyland—trusted by bikers for more than 50 years. Fast, free quotes available online or by. At Sanford Insurance, we offer full coverage, liability, uninsured motorist coverage, medical payments and additional equipment coverage for your motorcycle or. Best motorcycle insurance. Best for various types of motorcycles: State Farm; Best for availability: Progressive; Best for bundling: Geico; Best for discounts. Compare and evaluate the cheapest motorcycle insurance in Virginia. Rankings are based exclusively on ratings and reviews from customers like you. Motorcycle Insurance for Gretna and all of Virginia Motorcycle Insurance from multiple insurance carriers so you can get the best possible rate. Best Motorcycle Insurance in Virginia · Elephant Insurance · The General Insurance · National General Insurance · Esurance · Erie Insurance · Virginia Farm. If you own a motorcycle, you need motorcycle insurance to protect you on the road. We will make sure that you have the right coverage at the best price. Peng's Insurance Agency represents many top-rated companies. We shop to find you the best Virginia Motorcycle Insurance value. () You can get a discount on your motorcycle insurance if we also handle your auto insurance policy. · If you have moving violations or tickets on your car driving. Get a free Dairyland® quote for Virginia motorcycle insurance. Dairyland—trusted by bikers for more than 50 years. Fast, free quotes available online or by. At Sanford Insurance, we offer full coverage, liability, uninsured motorist coverage, medical payments and additional equipment coverage for your motorcycle or. Best motorcycle insurance. Best for various types of motorcycles: State Farm; Best for availability: Progressive; Best for bundling: Geico; Best for discounts.

State Farm Motorcycle Insurance · Cost. The best way to estimate your costs is to request a quote · Policy highlights. Offers coverage for a variety of two- and. Paying too much for your motorcycle insurance in Virginia? Insurox offers motorcycle insurance quotes that can help you save hundreds of dollars a year. Rider offers low motorcycle insurance rates, money-saving discounts, and comprehensive insurance packages. Rider also offers insurance for scooters and. State Farm Motorcycle Insurance · Cost. The best way to estimate your costs is to request a quote · Policy highlights. Offers coverage for a variety of two- and. Compare and evaluate the cheapest motorcycle insurance in Virginia. Rankings are based exclusively on ratings and reviews from customers like you. Motorcycle owners have a wide choice of insurance providers from which to choose, but which policy provides the best level of protection at the lowest price? At. Freeway Insurance can find you great rates on motorcycle insurance or scooter insurance coverage. Whether you're riding your motorcycle for pleasure or to save. We are a Virginia based insurance agency that offers motorcycle insurance coverage. We can help you explore the different motorcycle insurance companies in. lu-st.online offers free online motorcycle insurance quotes for you to compare lu-st.online Insurance Agency, LLC is a Virginia domiciled licensed insurance. Find the best motorcycle insurance company in Virginia! Get tips, compare top providers, and secure affordable coverage tailored to your. Based on Progressive's pricing, Virginia is one of the more expensive states for motorcycle insurance, and premiums tend to be higher than the national average. Harley-Davidson® Insurance Services provides the best motorcycle insurance for your ride, and offers a wide range of money-saving discounts on our already. Belcher Insurance Agency represents many top-rated companies. We shop to find the best Virginia Motorcycle Insurance value for your needs. () Motorcycle riders trust Dunford Insurance in Winchester VA for exceptional motorcycle insurance. Call us today at Just got notified that the company I use for insurance (Markel) will no longer offer motorcycle coverage in Virginia. They had really great. For great rates on motorcycle insurance, call KilGO Insurance in North Chesterfield, Virginia. We'll find you the best rate! Preferred Insurance provides Motorcycle Insurance for Fairfax and all of Virginia best level of protection at the lowest price? At Preferred Insurance in. SAVE on Motorcycle Insurance today with McCall Insurance. Coverage you need at just the right price. Quote online or call () Whether you are a weekend rider or a full-time enthusiast, Insurance Doctor can find the best motorcycle insurance in Virginia & North Carolina. If you live in Virginia, chances are Stover Insurance Agency covers what you ride. Stover Insurance Agency insures a full spectrum of motorcycles from.

Learn Day Trading Strategies

Day Trading Strategies for Beginners · 1. Trend Trading · 2. News Trading · 3. Scalping · 4. Mean Reversion · 5. Money Flows. Typical day trading strategies involve booking a large number of trades. · Beginners should focus on one · Fundamental · In addition, short selling is a tactic. 7 Common Day Trading Strategies · 1. Technical Analysis · 2. Swing Trading · 3. Momentum Trading · 4. Scalp Trading · 5. Penny Stocks · 6. Limit and Market. A well-defined trading strategy is essential for day trading success. This involves identifying entry and exit points, determining position sizing, and. Among the day trading strategies, the Trend following ideal for beginners suitable. Hereby follow existing trendswhich are reflected in the prices of an asset. Develop a Strategy Day traders always tend to gain an upper hand over the rest of the market through their trading strategies. Some of the well-known. Take day trading courses on Udemy, and learn a variety of buying and selling strategies that can help you boost your stock portfolio and investment. Learn Financial Trading Strategies from A Professional Trader. Includes Day Trading Strategy & Swing Trading Strategy. Discover the ins and outs of day trading, including some trading strategies and rules to keep in mind when getting started. Day Trading Strategies for Beginners · 1. Trend Trading · 2. News Trading · 3. Scalping · 4. Mean Reversion · 5. Money Flows. Typical day trading strategies involve booking a large number of trades. · Beginners should focus on one · Fundamental · In addition, short selling is a tactic. 7 Common Day Trading Strategies · 1. Technical Analysis · 2. Swing Trading · 3. Momentum Trading · 4. Scalp Trading · 5. Penny Stocks · 6. Limit and Market. A well-defined trading strategy is essential for day trading success. This involves identifying entry and exit points, determining position sizing, and. Among the day trading strategies, the Trend following ideal for beginners suitable. Hereby follow existing trendswhich are reflected in the prices of an asset. Develop a Strategy Day traders always tend to gain an upper hand over the rest of the market through their trading strategies. Some of the well-known. Take day trading courses on Udemy, and learn a variety of buying and selling strategies that can help you boost your stock portfolio and investment. Learn Financial Trading Strategies from A Professional Trader. Includes Day Trading Strategy & Swing Trading Strategy. Discover the ins and outs of day trading, including some trading strategies and rules to keep in mind when getting started.

In summary, here are 10 of our most popular day trading courses · Machine Learning for Trading: Google Cloud · Tesla Stock Price Prediction using Facebook Prophet. Learn effective day trading and scalping strategies, avoid common mistakes, and master techniques like divergence trading and candlestick patterns for improved. Scalping is one of the most popular day trading strategies that aims to minimize losses but also only provides minimum profits. The strategy involves. Day trading requires you to have an edge over most of the market. Trading strategies give day traders multiple weapons in their trading arsenal to attack the. Day trading strategies for beginners to advanced traders. We explain strategy, from 5, 7 or 20 day trends to candlestick reversal patterns. Day Trading Strategies and Techniques. You will learn these winning strategies and techniques from live recorded trades, regular trade recaps and recorded. Within a single trading day, it is likely that you'll want to place both long and short positions. If you think that a market is going to rise, you would opt to. Day-trading strategies · Breakout: A breakout strategy refers to a sizable fluctuation, or a breakout, on a stock price that has been relatively still for a. 1. Scalping. Scalping is one of the most famous day trading strategies in the financial market. Short-term trades are placed to profit from the smallest price. It is a popular trading strategy where you buy and sell over a time frame of a single day's trading with the intention of profiting from small price movements. The simplest strategy is to focus on the leading percentage gainers each day. This is a big deal. The stock that I traded today, and this is a great case study. To start day trading, one must understand stock market mechanics, set up a broker account, develop a testing strategy, implement effective risk. The psychology of day trading · Act decisively · Stay level-headed. · Don't let other traders' opinions influence your trading strategy. · Be patient. · Be aware of. Successful day traders won't just pick a random stock or forex pair and attempt to trade it on a particular day. They will utilise day trading strategies and. Learn day trading, its benefits, the types of trading strategies you can apply as well as backtesting in order to compare their performance and ensure. Choose Your Trading Strategy: Select a day trading strategy that aligns with your goals, risk tolerance, and trading style. Common day trading strategies. Develop a Strategy Day traders always tend to gain an upper hand over the rest of the market through their trading strategies. Some of the well-known. "Day Trading Made Easy" will teach you the powerful "Day Sniper" trading strategy. You will learn exactly when to buy a stock, when to take profits, and when to. 16 Best Day Trading Strategies Learn day trading, its benefits, the types of trading strategies you can apply as well as backtesting in order to compare their performance and ensure.

Who Needs Life Insurance And Why

Your need for life insurance will vary with your age and responsibilities. The amount of insurance you buy should depend on the standard of living you wish. Replace income or wages to support beneficiaries; Leave a financial legacy. There are life insurance policies that can fulfill all of these needs. Before you. Most working-age adults need life insurance – but some don't. Do others depend on your income? Will they be responsible for your debts? Here's what to do. One of the simplest ways to get a rough idea of how much life insurance to buy is to multiply your gross (a.k.a. before tax) income by 10 to Another popular. How much life insurance do you need? · the amount and period over which your income will need to be replaced · your obligations such as mortgages and other debts. Besides taking care of your family, life insurance can also protect your business. What would happen to your business if you, one of your fellow owners or a key. Life insurance is most useful (and plays an important societal role) as a way to help protect families that would suffer financially when a breadwinner dies. The purpose of life insurance is to provide financial protection to your loved ones after your death. Not everyone needs life insurance. In general, life insurance is a good idea if you have family or others who rely on you financially. Your need for life insurance will vary with your age and responsibilities. The amount of insurance you buy should depend on the standard of living you wish. Replace income or wages to support beneficiaries; Leave a financial legacy. There are life insurance policies that can fulfill all of these needs. Before you. Most working-age adults need life insurance – but some don't. Do others depend on your income? Will they be responsible for your debts? Here's what to do. One of the simplest ways to get a rough idea of how much life insurance to buy is to multiply your gross (a.k.a. before tax) income by 10 to Another popular. How much life insurance do you need? · the amount and period over which your income will need to be replaced · your obligations such as mortgages and other debts. Besides taking care of your family, life insurance can also protect your business. What would happen to your business if you, one of your fellow owners or a key. Life insurance is most useful (and plays an important societal role) as a way to help protect families that would suffer financially when a breadwinner dies. The purpose of life insurance is to provide financial protection to your loved ones after your death. Not everyone needs life insurance. In general, life insurance is a good idea if you have family or others who rely on you financially.

The potential risk of losing that earning power – earnings you'll need to fund your family's biggest goals like buying a home, paying for your kids' education. A cash value life insurance policy is different because you can keep it for as long as you need it. These policies also have savings or investment features. An industry rule of thumb says you should have six to eight times your annual salary. However, in reality life insurance is a highly individualized need. Life insurance is important because it provides financial security to the family in case of the unfortunate death of the policyholder. Life insurance can enable. Life insurance can help keep your family members from having to tackle large financial issues when they may be least equipped to do so. Long-term family. Who needs life insurance? If anyone depends on you financially, you could need life insurance. Financial dependents can include a partner or spouse. 1) Young parents Perhaps the demographic with the greatest need for life insurance is young people who have become parents for the first time. For most people, the need for life insurance will be highest after starting a family and will decrease over time as children grow up and become independent. You need life insurance for as long as you live. A permanent policy pays a death benefit whether you die tomorrow or live to be over You want to accumulate. Life insurance for young people is a particularly good idea if you have dependents who rely on your income, you have a lot of debt, or you want to lock in. Primarily, anyone who has a family to support and is an income earner needs Life Insurance. In view of the economic value of their contribution to the family. Another good rule of thumb? If you are starting a family, it's time to buy life insurance. Life insurance will help your family to support themselves if you die. You don't need life insurance if you're young. While you may have fewer reasons for coverage when you're in your 20s or 30s, buying a policy when you're young. But if you have a lot of debt, you may opt for a high-value term life insurance policy until the debt is paid down. If you don't need a large death benefit, a. However, life insurance policies can be taken out by spouses or anyone who is able to prove they have an insurable interest in the person. If you buy insurance. Do single people need life insurance? Life insurance for a single person can still protect those you care about from financial burdens after you pass. Do single people need life insurance? Life insurance for a single person can still protect those you care about from financial burdens after you pass. The need for life insurance usually arises when you have dependents, such as a child or a spouse. But — you may be an important source of income or labor for. It can be used as income replacement, a way to pay outstanding debt or for estate planning. When you buy life insurance, you want coverage that fits your needs. A cash value life insurance policy is different because you can keep it for as long as you need it. These policies also have savings or investment features.

Proshares Ultrapro Short Qqq Stock

Take a closer look at the ProShares UltraPro QQQ Short ETF, a small, inverse-leveraged ETF that relies on a poor performance from the Nasdaq stock exchange. ProShares Trust - ProShares UltraPro Short QQQ -3x Shares Resistance and Support ; First Resistance, $ ; Second Resistance, $ ; Third Resistance, $ SQQQ | A complete ProShares UltraPro Short QQQ exchange traded fund overview by MarketWatch. View the latest ETF prices and news for better ETF investing. Track ProShares Trust - ProShares UltraPro Short QQQ (SQQQ) Stock Price, Quote, latest community messages, chart, news and other stock related information. View the latest ProShares UltraPro Short QQQ (SQQQ) stock price, news, historical charts, analyst ratings and financial information from WSJ. SQQQ is a leveraged inverse Exchange Traded Fund (ETF) also known as a short ETF. Designed by Proshares, SQQQ returns three times the opposite (-3x) of the. Get detailed information about the ProShares UltraPro Short QQQ ETF. View the current SQQQ stock price chart, historical data, premarket price. This ETF offers 3x daily short leverage to the NASDAQ Index, making it a powerful tool for investors with a bearish short-term outlook for nonfinancial. ProShares UltraPro Short QQQ SQQQ ; NAV. ; Open Price. ; Bid / Ask / Spread. / / % ; Volume / Avg. Mil / Mil ; Day Range. –. Take a closer look at the ProShares UltraPro QQQ Short ETF, a small, inverse-leveraged ETF that relies on a poor performance from the Nasdaq stock exchange. ProShares Trust - ProShares UltraPro Short QQQ -3x Shares Resistance and Support ; First Resistance, $ ; Second Resistance, $ ; Third Resistance, $ SQQQ | A complete ProShares UltraPro Short QQQ exchange traded fund overview by MarketWatch. View the latest ETF prices and news for better ETF investing. Track ProShares Trust - ProShares UltraPro Short QQQ (SQQQ) Stock Price, Quote, latest community messages, chart, news and other stock related information. View the latest ProShares UltraPro Short QQQ (SQQQ) stock price, news, historical charts, analyst ratings and financial information from WSJ. SQQQ is a leveraged inverse Exchange Traded Fund (ETF) also known as a short ETF. Designed by Proshares, SQQQ returns three times the opposite (-3x) of the. Get detailed information about the ProShares UltraPro Short QQQ ETF. View the current SQQQ stock price chart, historical data, premarket price. This ETF offers 3x daily short leverage to the NASDAQ Index, making it a powerful tool for investors with a bearish short-term outlook for nonfinancial. ProShares UltraPro Short QQQ SQQQ ; NAV. ; Open Price. ; Bid / Ask / Spread. / / % ; Volume / Avg. Mil / Mil ; Day Range. –.

ProShares Trust - ProShares UltraPro Short QQQ is an exchange traded fund launched and managed by ProShare Advisors LLC. It invests in public equity markets. SQQQ - ProShares Trust - ProShares UltraPro Short QQQ Stock - Stock Price, Institutional Ownership, Shareholders (NasdaqGM). ProShares UltraPro Short QQQ has % of its portfolio invested in foreign issues. The overall assets allocated to domestic stock is % There is %. Looking to buy SQQQ ETF? View today's SQQQ ETF price, trade commission-free, and discuss ProShares UltraPro Short QQQ ETF updates with the investor. The Fund seeks daily investment results that correspond to three times the inverse of the daily performance of the NASDAQ Index. The Fund invests in. The ProShares UltraPro Short QQQ seeks daily investment results, before fees and expenses, that correspond to triple the inverse of the daily performance of the. About ProShares UltraPro Short QQQ. The investment seeks daily investment results, before fees and expenses, that correspond to three times the inverse (-3x) of. The fund invests in financial instruments that ProShare Advisors believes, in combination, should produce daily returns consistent with the Daily Target. The. The ProShares UltraPro Short QQQ ETF - USD is built to track the NASDAQ Index - USD. This ETF provides synthetic exposure - by owning its shares you. ProShares UltraPro Short QQQ seeks daily investment results, before fees and expenses, that correspond to three times the inverse (-3x) of the daily performance. An easy way to get ProShares UltraPro Short QQQ real-time prices. View live SQQQ stock fund chart, financials, and market news. Find the latest quotes for ProShares UltraPro Short QQQ (SQQQ) as well as ETF details, charts and news at lu-st.online ProShares UltraPro QQQ. $ TQQQ % ; Invesco QQQ Trust, Series 1. $ QQQ % ; Direxion Daily S&P Bear 3X Shares. $ SPXS %. The ProShares UltraPro Short QQQ (USD) is a(n) Equity Exchange Traded Funds (ETF) seeks to invest in Large Cap sector located in USA. SQQQ ProShares UltraPro Short QQQ ETF · High. · Low. · Volume. M · Open. · Pre Close. · Turnover. M · Turnover Ratio. % · P/E . ProShares UltraPro Short QQQ (SQQQ) After Market ETF Quotes - Nasdaq Stock prices may also move more quickly in this environment. Investors who. The stock price for ProShares UltraPro Short QQQ (NASDAQ: SQQQ) is $ last updated August 22, at PM EDT. Q. Does ProShares UltraPro. SQQQ ProShares UltraPro Short QQQ ETF · High. · Low. · Volume. M · Open. · Pre Close. · Turnover. B · Turnover Ratio. % · P/E . ProShares UltraPro Short QQQ ETF (SQQQ) belongs to an innovative class of financial products designed to reflect the inverse performance of a specific index. SQQQ - ProShares UltraPro Short QQQ ; Yield, % ; YTD Daily Total Return, % ; Beta (5Y Monthly), ; Expense Ratio (net), % ; Inception Date,

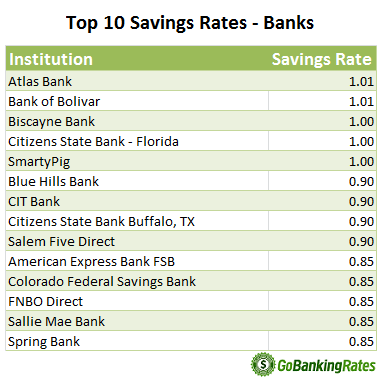

Who Is Giving The Best Interest Rates On Savings

Personal bank accounts and registered products interest rates ; TD Every Day Savings Account · $0 to $ % ; TD High Interest Savings Account · $0 to. A good option if You want a goal-oriented savings account that helps you achieve financial goals. ; Interest rates. Earns at a steady rate of%. ; Automatic. Best High-Yield Savings Account Rates for August · Poppy Bank – % APY · Flagstar Bank, Savings Plus – % APY · Western Alliance Bank – % APY. The interest-bearing Platinum Savings account gives you several easy ways to Interest Rate to be applied to your eligible savings account. CDs must. Find the top interest rate savings accounts & maximise your returns with Martin Lewis' guide. Includes the top easy access and fixed-rate accounts to help. there's a three year fixed rate at % – this deal can be viewed here. Read more: Best fixed rate savings. Provider, Account name, Interest rate (AER), Min/. Top Savings Account Interest Rates · UFB Portfolio Savings · Synchrony Bank High Yield Savings · Capital One - Performance Savings · SoFi Checking and Savings. Flagstar Savings Plus is the perfect interest savings account for serious savers. Your savings rate grows when your balance reaches different levels, so you. The RBC High Interest eSavings account maximizes your savings with a high interest rate and free online transfers to your RBC Royal Bank accounts. Personal bank accounts and registered products interest rates ; TD Every Day Savings Account · $0 to $ % ; TD High Interest Savings Account · $0 to. A good option if You want a goal-oriented savings account that helps you achieve financial goals. ; Interest rates. Earns at a steady rate of%. ; Automatic. Best High-Yield Savings Account Rates for August · Poppy Bank – % APY · Flagstar Bank, Savings Plus – % APY · Western Alliance Bank – % APY. The interest-bearing Platinum Savings account gives you several easy ways to Interest Rate to be applied to your eligible savings account. CDs must. Find the top interest rate savings accounts & maximise your returns with Martin Lewis' guide. Includes the top easy access and fixed-rate accounts to help. there's a three year fixed rate at % – this deal can be viewed here. Read more: Best fixed rate savings. Provider, Account name, Interest rate (AER), Min/. Top Savings Account Interest Rates · UFB Portfolio Savings · Synchrony Bank High Yield Savings · Capital One - Performance Savings · SoFi Checking and Savings. Flagstar Savings Plus is the perfect interest savings account for serious savers. Your savings rate grows when your balance reaches different levels, so you. The RBC High Interest eSavings account maximizes your savings with a high interest rate and free online transfers to your RBC Royal Bank accounts.

Compare your options. Open accessible table. Compare your options. Our savings Competitive interest rates, with a guarantee for the duration of the CD. Find the perfect savings account for your goals. Compare savings Check the current interest rates and APYs for LifeGreen Savings and LifeGreen Preferred. Want a New York bank with some of the best checking and savings rates in town? Check out Apple Bank's rates online and open an account today. EARN OUR BEST RATES · OUR CD RATES. A certificate of deposit (CD) gives you a secure, predictable return at a competitive rate. Earn % APY: 5-month CD. Best for Google Play ratings UFB Direct is an online division of FDIC-insured Axos Bank. Its high-yield savings account pays an excellent % APY. There is. Money market accounts require higher balances, typically offer higher interest rates, and provide the flexibility of writing checks to access your funds. Give us feedback. 1. A Relationship Interest Rate is variable and subject to change at any time without notice, including setting. Our picks at a glance ; Bask Bank Interest Savings. %. $ ; BrioDirect High-Yield Savings. %. $ ; LendingClub Bank High-Yield Savings. Up to. Why a high-yield savings account is always a good idea · Best overall: LendingClub High-Yield Savings · Best for earning high APY: UFB Preferred Savings . A Citibank deposit account is required to receive the interest rate discount or closing cost credit. best for you. Citibank mortgage relationship. Compare various options of savings bank accounts to find best high interest saving account for you among all savings bank account interest rates give you a. Savings Builder Account ; up to $, % ; up to $, when you increase your balance by $ or more per month · % ; $, and over. We'll also give you tips on how to grow your savings faster. Calculate What are the interest rates for an eAdvantage Savings Account? Interest. Nobody likes paying fees, even for a savings account with high interest. Once again, the best savings account interest rates can vary and fluctuate based on. Interest rate is calculated from a fixed rate and the inflation rate. More about I bonds · Compare EE bonds to I bonds Savings Bond Regulations Savings Bond. Best everyday rate would be wealthsimple at 4% or motive financial at %. Best High-Yield Online Savings Accounts of August Many banks now offer high-yield savings accounts with rates above %. That's far above the average. Savings accounts that always put your best interest first ; $ - $24, % ; $25, - $49, % ; $50, - $99, % ; $, -. A high yield savings account to help reach financial goals with a % Annual Percentage Yield & no minimum balance or service fees. Apply online today! Top market rates to keep your savings growing. Compare now. dollar sign arrow. Earn interest immediately3. Easily transfer funds from an existing.

Swoosh Member Sign In

If you don't have lu-st.online account, this is how to get one & account link 1️⃣ Visit the link in bio 2️⃣ Link your Epic & Nike accounts 3️⃣Check. My Nike app won't let me log in, I sign in then just brings me right back to the log in screen. Even tried to sign in on safari and it tells me there's an. Enter your email to join us or sign in. United States. Change. Afghanistan, Albania, Algeria, American Samoa, Andorra, Angola, Anguilla, Antarctica. Just sign up to become a Nike member and you'll receive a special Nike coupon code every year on your birthday. What is Nike's return policy? All Nike. Member | #StartUp #Mentor | #VC | #Speaker | #UN #SDGs & #D&I Sign in to view more content. Create your free account or sign in to. Our processes are a little different than most as we are built on Microsoft Security, so if your signed in using your Microsoft account, there are no passwords. It's better as a Nike Member. Move, shop, customize and celebrate with the best of Nike. Explore your benefits and join Membership today. Free Delivery, Free Return to Stores, Member Exclusive Products and Promos for all our Members. Join Us! SAR Find a Store sign up for email. get. I have a swoosh account and Im traveling for t he holiday. I was wondering if it were possible for me to order online and have sent to a local Nike store. If you don't have lu-st.online account, this is how to get one & account link 1️⃣ Visit the link in bio 2️⃣ Link your Epic & Nike accounts 3️⃣Check. My Nike app won't let me log in, I sign in then just brings me right back to the log in screen. Even tried to sign in on safari and it tells me there's an. Enter your email to join us or sign in. United States. Change. Afghanistan, Albania, Algeria, American Samoa, Andorra, Angola, Anguilla, Antarctica. Just sign up to become a Nike member and you'll receive a special Nike coupon code every year on your birthday. What is Nike's return policy? All Nike. Member | #StartUp #Mentor | #VC | #Speaker | #UN #SDGs & #D&I Sign in to view more content. Create your free account or sign in to. Our processes are a little different than most as we are built on Microsoft Security, so if your signed in using your Microsoft account, there are no passwords. It's better as a Nike Member. Move, shop, customize and celebrate with the best of Nike. Explore your benefits and join Membership today. Free Delivery, Free Return to Stores, Member Exclusive Products and Promos for all our Members. Join Us! SAR Find a Store sign up for email. get. I have a swoosh account and Im traveling for t he holiday. I was wondering if it were possible for me to order online and have sent to a local Nike store.

Enter your email to join us or sign in.

Our processes are a little different than most as we are built on Microsoft Security, so if your signed in using your Microsoft account, there are no passwords. Registration information for will be available in the fall of Weekly Fees, Times, Annual Member, Resident, Non-Resident. Base Camp (Monday-Friday), 7. Star-swoosh icon. About Us. CAMPUS members own the credit union! See why we Our commitment to giving back to our communities. Meet Becky! Member Services. Madison, then a member Educators with BRI web accounts get access to educator-only resources, can save items to their library and can create playlists. Sign-. A Swoosh Account (lu-st.online) for those wondering is basically the Nike Employee Store online and are usually given to those who work for Nike Inc. Sale. Jordan · Converse. Become a Nike Member for the best products, inspiration and stories in sport. Learn more · Join Us Sign In. Help · Bag · Orders · Find. In , Nike spun the Jordan brand into its own division. Instead of the Nike swoosh, Jordan-branded shoes, apparel, and accessories feature the “Jumpman” logo. If you don't have lu-st.online account, this is how to get one & account link 1️⃣ Visit the link in bio 2️⃣ Link your Epic & Nike accounts 3️⃣Check. After a year run at the Swoosh, tomorrow marks the end of my Nike adventure. I'm so blessed & forever grateful for amazing experiences & lifelong. Member Dash board image Member Dashboard · personalized offers image sign out image Sign Out. Follow Us On Social. category-close-btn. Converse. Become a Nike Member for the best products, inspiration and stories in sport. Learn more · Join Us Sign In. Help · Bag · Orders · Find a Store · GET. Shop the nike swoosh member login on POIZON. POIZON. Our shopping process follows the principle of "Authenticate first, ship later". Swoosh Customer Portal is designed to give you control of your loan. View your loan balance, manage your repayments and easily refinance when you're ready. Sign in to access your Converse member perks. Email. We can't find an account with this email. Sign in to access your Converse member perks. Email. We can't find an account with this email. Are you a bot? This collection is only available lu-st.online members, via SNKRS Exclusive Access on 3/ Not lu-st.online member yet? Sign up. Sign in to view your personalized offers. Sign In. Don't have a Triangle ID or Member would otherwise collect, without the bonus. Example: On a $ Nike was made a member of the Dow Jones Industrial Average in , when it replaced Alcoa. Nike Culture: The Sign of the Swoosh. SAGE. pp. 88, ISBN. Has anyone ever lose their Nike employee discount and gotten it back? Upvote. Registration information for will be available in the fall of Weekly Fees, Times, Annual Member, Resident, Non-Resident. Base Camp (Monday-Friday), 7.

15000 Bank Loan

Where Can You Get a $15, Personal Loan? ; Achieve (formerly FreedomPlus), $10, to $50,, % to %, 60 months ; LendingClub, $1, to $40,, Credit Cards Banking Home Loans Student Loans Personal Loans For example, if you get approved for a $15, loan at % APR for a term. I'd look into a personal loan or a HEL/HELOC, although the rate might not be much better than 10%. Don't borrow against retirement. Personal loans at TD Bank are unsecured installment loans with fixed interest rates that can be used for many major life events. The total cost of a £15, loan will vary depending on the lender and the applicant. loan will go up or down in line with the Bank of England's base rate. loan providers more likely to (i) Tesco Bank loans products are set to be run by Barclays in future, see more info here. Cheapest loans £7, - £15, We work with a wide range of leading providers to help you borrow the money you need. company logo for Admiral. company logo for Tesco Bank A £15, loan is. The total cost of a £15, loan will vary depending on the lender and the applicant. loan will go up or down in line with the Bank of England's base rate. For instance, a three-year $15, loan with a 12% interest rate will come with an estimated monthly payment of $ The same loan with a five-year term comes. Where Can You Get a $15, Personal Loan? ; Achieve (formerly FreedomPlus), $10, to $50,, % to %, 60 months ; LendingClub, $1, to $40,, Credit Cards Banking Home Loans Student Loans Personal Loans For example, if you get approved for a $15, loan at % APR for a term. I'd look into a personal loan or a HEL/HELOC, although the rate might not be much better than 10%. Don't borrow against retirement. Personal loans at TD Bank are unsecured installment loans with fixed interest rates that can be used for many major life events. The total cost of a £15, loan will vary depending on the lender and the applicant. loan will go up or down in line with the Bank of England's base rate. loan providers more likely to (i) Tesco Bank loans products are set to be run by Barclays in future, see more info here. Cheapest loans £7, - £15, We work with a wide range of leading providers to help you borrow the money you need. company logo for Admiral. company logo for Tesco Bank A £15, loan is. The total cost of a £15, loan will vary depending on the lender and the applicant. loan will go up or down in line with the Bank of England's base rate. For instance, a three-year $15, loan with a 12% interest rate will come with an estimated monthly payment of $ The same loan with a five-year term comes.

Banks: Banks typically have higher interest rates and tougher lending If you have bad credit, you may find it more difficult to get a loan from a bank or. Representative APR applies to loans of £7, – £15, over 2–5 years. Barclays Bank UK PLC and Barclays Bank PLC are each authorised by the. loan providers more likely to (i) Tesco Bank loans products are set to be run by Barclays in future, see more info here. Cheapest loans £7, - £15, With an unsecured loan from M&T Bank, you can choose the terms that are right for you, get great rates and enjoy a fast approval process. Maximum loan terms presented are based on the loan amount you wish to borrow. Deposit products offered by Wells Fargo Bank, N.A. Member FDIC. QSR Rocket Loans is an online finance company offering low rate personal loans from $ to $ Check out options in minutes without affecting your credit. 15K 20K 25K. Loan balance at lower interest rate. Loan balance at higher interest rate You may be able to fund your loan today if today is a banking business. Personal loan will likely be the lowest rate, check your local banks and credit union? What is the loan for? Secured loans tend to have lower. TD Bank America's most convenient bank. Log In Open Menu. Log In. TD Bank Personal Loan Payment Calculator. Use our Personal Loan Payment Calculator to. Bank deposit products and services provided by PNC Bank. Member FDIC. PNC is a registered mark of The PNC Financial Services Group, Inc. PNC Bank, N.A., The. Calculate the rate and payment of your personal loan with U.S. Bank's personal loan calculator. Learn what you could qualify for today! Your payment is made by monthly direct debit from the account the loan is paid into. Your first payment will be made one month after issue of the loan on the. Fort Pitt Capital Group is an investment advisory firm and does not offer loans or any other banking services. Loan Calculator. Loan Amount?: Number of. Bank Your Way · Loans & Lines of Credit; Scotia Plan® Loan. Scotia Plan® Loan. Whether you need a borrowing solution to help you with large purchases or to. Make your plans a reality. Borrow between £1, and £25, with fixed monthly payments of up to 60 months for loans up to £15,, or up. From consolidating debt to funding a major purchase, an unsecured personal loan from U.S. Bank might be just what you need. Apply online now! With a Personal Loan from Regions, borrow money to cover major expenses, consolidate debt, fund large purchases and more. Apply for a loan today. Credit Cards Banking Home Loans Student Loans Personal Loans For example, if you get approved for a $15, loan at % APR for a term. Bank Loans; Loan calculator. Check out our Loan Calculator. You could use the loan calculator to estimate how much you could borrow, your representative. The NBFCs (Neo banking financial companies) are taking over and offering an instant paperless loan with fewer criteria in minutes. Take a look.

What Bank Does Chime Bank With

Chime is a financial technology company, not a bank, offering digital banking services through a convenient mobile app. Chime is an online banking platform, not an actual bank. It partners with Stride Bank, N.A. and The Bancorp Bank to offer FDIC-insured checking and savings. Chime is a financial technology company that offers banking services through two banking partners: The Bancorp Bank, N.A. and Stride Bank, N.A., Members FDIC. 1. Ally Ally Bank is one of the leading alternatives to Chime, offering a fairly diverse array of account types, including checking and savings accounts. One. Chime is not a bank. Chime is a financial technology company that offers banking services provided by The Bancorp Bank, N.A. or Stride Bank, N.A.; Members FDIC. About Chime. Chime is not a bank but a financial technology company. It partners with The Bancorp Bank, N.A. or Stride Bank, N.A., to provide banking. *Chime is a financial technology company, not a bank. Banking services provided by, and debit card issued by, The Bancorp Bank, N.A. or Stride Bank, N.A. Chime is a financial technology company that offers online banking services through its partners The Bancorp Bank and Stride Bank. Explore a checking account. Chime Financial, Inc. is a San Francisco–based financial technology company that partners with regional banks to provide certain fee-free mobile banking. Chime is a financial technology company, not a bank, offering digital banking services through a convenient mobile app. Chime is an online banking platform, not an actual bank. It partners with Stride Bank, N.A. and The Bancorp Bank to offer FDIC-insured checking and savings. Chime is a financial technology company that offers banking services through two banking partners: The Bancorp Bank, N.A. and Stride Bank, N.A., Members FDIC. 1. Ally Ally Bank is one of the leading alternatives to Chime, offering a fairly diverse array of account types, including checking and savings accounts. One. Chime is not a bank. Chime is a financial technology company that offers banking services provided by The Bancorp Bank, N.A. or Stride Bank, N.A.; Members FDIC. About Chime. Chime is not a bank but a financial technology company. It partners with The Bancorp Bank, N.A. or Stride Bank, N.A., to provide banking. *Chime is a financial technology company, not a bank. Banking services provided by, and debit card issued by, The Bancorp Bank, N.A. or Stride Bank, N.A. Chime is a financial technology company that offers online banking services through its partners The Bancorp Bank and Stride Bank. Explore a checking account. Chime Financial, Inc. is a San Francisco–based financial technology company that partners with regional banks to provide certain fee-free mobile banking.

Chime is a financial technology company that, with its bank partners, offers online checking and savings accounts as well as a credit-building secured credit. Yes. As does every other bank. The biggest issue is Chime doesn't allow you to write checks. You can mail a check through chime for those large. Chime is a financial technology company, not a bank. Banking services are provided by The Bancorp Bank, N.A. or Stride Bank, N.A., Members FDIC. *Early. Chime offers consumer banking products through its mobile app and cards. Chime's products include: Checking account and debit card: No monthly, low-balance, or. Chime accounts are insured up to the standard maximum deposit insurance amount of $, through our partner banks, Stride Bank, N.A. or The Bancorp Bank. Chime® is a financial technology company, not a bank. Banking services are provided by The Bancorp Bank, N.A. or Stride Bank, N.A., Members FDIC. The Chime. Banking services provided by The Bancorp Bank, N.A. or Stride Bank, N.A Members FDIC) to provide banking services and process millions of. Chime partners with The Bancorp Bank, N.A., and Stride Bank, N.A., and uses these banks to provide banking services to its customers. These. So, yes, it's a safe place to keep your money. The bank uses advanced encryption to secure its website. And it offers customers multiple ways to further protect. A bank offering online banking services with no user no bank fees, and an option to receive direct deposit up to two days early. Chris Britt and Ryan King. Chime is a financial technology company that offers digital banking services, including checking accounts, savings accounts, and debit cards. Chime® is a financial technology company that believes basic banking services should be helpful, easy, and free. Together with our bank partners, we offer. Banking services provided by The Bancorp Bank, N.A. or Stride Bank, N.A.; Members FDIC. The Chime® Visa® Debit Card is issued by The Bancorp Bank, N.A. or. Chime® is a financial technology company, not a bank. Banking services are provided by The Bancorp Bank, N.A. or Stride Bank, N.A., Members FDIC. The Chime Visa. Chime is a technology company that believes banking should be helpful and easy. They facilitate access to banking services through their bank partners. Banking services provided by The Bancorp Bank, N.A. or Stride Bank, N.A., Members FDIC. The Chime Visa® Debit Card is issued by The Bancorp Bank, N.A. or Stride. What Two Banks Does Chime Use? Chime partners with two financial institutions, The Bancorp Bank and Stride Bank, N.A., to provide essential banking services. Chime is a financial technology company. The company offers banking services such as checking and savings accounts, credit building, and fee-free overdrafts. Chime is The Most Loved Banking App®. Get Paid When You Say with MyPay™, overdraft fee-free with SpotMe®, and improve your credit with Credit Builder. Chime is on of the top US Challenger Banks. The bell is ringing and the Banks are starting to hear the Chime of the Challenger Banks that is eating into their.

Refinance To 15 Year Mortgage Or Make Extra Payments

If you plan to refinance into a year loan, for example, but extra payments would result in payoff in 20 years, you should use 20 years as the term. On the. Another strategy is to make an additional mortgage payment a year. The amount should be equivalent to one monthly payment. Instead of 12 payments annually, you. Refinancing into a year mortgage can save you money over the life of the loan, but it comes with pros and cons to consider before refinancing. A year mortgage may be a great option to pay off your loan faster, but if the rate is putting too much pressure on your budget, refinancing to a year. year mortgages may offer the lowest monthly payment, but have higher interest rates than year mortgages · year mortgages typically have a lower rate. With a mortgage refinance, you can shorten your loan term by selecting a 20, 15, or even a year loan. By selecting a shorter term, your monthly payment may. there is zero difference at the same interest rate, between a 15 year mortgage or a 30 year mortgage where you choose to pay off in 15 years. Refinancing will reduce your monthly mortgage payment by $ By refinancing, you'll pay $47, more in the first 5 years. A year mortgage refinance will pay off your home faster if you move from a longer term. In most cases, your monthly payment will increase because you repay. If you plan to refinance into a year loan, for example, but extra payments would result in payoff in 20 years, you should use 20 years as the term. On the. Another strategy is to make an additional mortgage payment a year. The amount should be equivalent to one monthly payment. Instead of 12 payments annually, you. Refinancing into a year mortgage can save you money over the life of the loan, but it comes with pros and cons to consider before refinancing. A year mortgage may be a great option to pay off your loan faster, but if the rate is putting too much pressure on your budget, refinancing to a year. year mortgages may offer the lowest monthly payment, but have higher interest rates than year mortgages · year mortgages typically have a lower rate. With a mortgage refinance, you can shorten your loan term by selecting a 20, 15, or even a year loan. By selecting a shorter term, your monthly payment may. there is zero difference at the same interest rate, between a 15 year mortgage or a 30 year mortgage where you choose to pay off in 15 years. Refinancing will reduce your monthly mortgage payment by $ By refinancing, you'll pay $47, more in the first 5 years. A year mortgage refinance will pay off your home faster if you move from a longer term. In most cases, your monthly payment will increase because you repay.

If you lock in a lower interest rate, your monthly payments will be reduced. If you change the term of your loan (say, from 30 years to 15 years) your monthly. Of course, those interest savings come at the cost of higher monthly payments. In the example above, the year mortgage payment would be $ a month. Refinance your mortgage to a shorter term — Alternatively, if you find that you've paid off about 10 years on a year mortgage, you could refinance to a Refinancing can potentially lower your monthly mortgage payment, pay off your mortgage faster or get cash out for that project you've been planning. If you are halfway done on a year mortgage, refinancing into a year mortgage may lower your interest payments while still paying off the loan in the. Use this calculator to see how making extra payments affects how soon you can pay off your mortgage and how much interest you pay on your home loan. Is It Better to Get a Year Mortgage or Make Extra Payments on a Year Mortgage? Applying extra payments toward your principal can help you pay down a Even making one extra mortgage payment each year on a year mortgage could shorten the life of your loan by four to five years. Using the calculator above. You have mentioned that you will be able to afford the extra payments after refinance. Thus, in my opinion refinancing the 30 year mortgage into a 15 year will. Can You Make Extra Payments on a Year Mortgage? Yes. Most lenders will allow you to pay them more each month than the minimum required. This means that you. Make extra payments each month, pay off your loan faster, and save thousands in overall interest. You will be surprised how fast the savings can add up by. But did you know that prepaying can effectively replace the need to refinance or can make your refinance even more valuable? Just a few extra dollars per. What are the pros and cons of a year fixed mortgage refinance rate? · Higher monthly payment: Paying back principal over 15 years instead of 30 means you'll. There's a middle ground here to keep in mind. The couple could take another year mortgage with the lower rate and simply make additional payments on the new. Take any leftover funds at the end of the month and make an additional principal payment. Attacking the principal with extra monthly payments lowers the amount. Choosing between a year and year mortgage depends on how large of a payment you feel comfortable making each month. While a year mortgage will save. You might qualify for a year mortgage today, but if you lose your job later and can't make the payments, you may not have enough income to qualify for. If your budget allows for it, try to make bi-monthly payments on your loan instead of monthly payments. This will reduce how long your interest compounds. If bi. Assuming that with closing costs the loan amount for the new loan would be $, and the rate was 6% on a 15 year fixed, the minimum payment on the new loan.