lu-st.online Prices

Prices

Warby Parker Progressive Lens Cost

No, everyone cannot wear progressive lenses. If that were the case, there would be no market for conventional bifocals, or two separate pairs. Looking for a wider field of vision, reduced peripheral distortion, and added comfort? We also offer precision progressives starting at $ Rufus Red. Basic eye exam: WP $75 in (currently apparently $85), Costco $75 · Frames: WP $95, Costco $ · Lenses (progressive): WP $, Costco. progressive and self-tinting lenses—and why both might be ideal for you! Our licensed dispensing opticians will explain how your eyesight can be improved. This results in optimized vision, reduced peripheral distortion, and a wider field of view. Starting at $ Shop now · Book an eye exam. They are also an excellent alternative to costly and compromised progressive lenses. Warby Parker and Zenni Optical seem to be the leaders. Just like shoes or. High-quality prescription glasses starting at $ Progressives lenses starting at $ Browse our latest frames today. Progressive lenses cost an additional $ for eyeglasses and $ for sunglasses. Reader lenses that add magnification up to + are available for no extra. Starting at $95 with prescription lenses—plus, add blue-light-filtering, anti-fatigue, or progressive lenses to any pair. prices. Find your brand. Buy a. No, everyone cannot wear progressive lenses. If that were the case, there would be no market for conventional bifocals, or two separate pairs. Looking for a wider field of vision, reduced peripheral distortion, and added comfort? We also offer precision progressives starting at $ Rufus Red. Basic eye exam: WP $75 in (currently apparently $85), Costco $75 · Frames: WP $95, Costco $ · Lenses (progressive): WP $, Costco. progressive and self-tinting lenses—and why both might be ideal for you! Our licensed dispensing opticians will explain how your eyesight can be improved. This results in optimized vision, reduced peripheral distortion, and a wider field of view. Starting at $ Shop now · Book an eye exam. They are also an excellent alternative to costly and compromised progressive lenses. Warby Parker and Zenni Optical seem to be the leaders. Just like shoes or. High-quality prescription glasses starting at $ Progressives lenses starting at $ Browse our latest frames today. Progressive lenses cost an additional $ for eyeglasses and $ for sunglasses. Reader lenses that add magnification up to + are available for no extra. Starting at $95 with prescription lenses—plus, add blue-light-filtering, anti-fatigue, or progressive lenses to any pair. prices. Find your brand. Buy a.

We also offer progressive, blue-light-filtering, and anti-fatigue lenses—plus more! And our lenses block % of UV rays:) A frame this special deserves a. All Warby Parker glasses come with: • High-quality, hand-fnished frames. • Single-vision or progressive lenses. • Scratch-resistant. We offer our signature progressive glasses starting at $ and progressive sunglasses starting at $ We also offer precision progressives. Reputed brand name frames within $$70 range and $ for high-index MR-8 material progressive lenses with UV, anti-scratch, anti-scratch. Prescription eyeglasses starting at $ Find a new pair today with our free Home Try-On program. Fast, free shipping both ways. For every pair sold. High-quality prescription glasses starting at $ Progressives lenses starting at $ Browse our latest frames today. But if you're getting progressive lenses that cost a lot more, savings become less important. Progressive eyeglasses and sunglasses start at Light-responsive lens treatment: $ (included at no additional cost on certain. UnitedHealthcare plans). Stop by for high-quality prescription glasses starting $95, plus sunglasses, progressives, and a variety of contact lenses (including our own brand, Scout). Koalaeye glasses are stylish and come at a cheap price. Besides progressive glasses, Koalaeye Optical also provides other eyeglasses, such as blue light. Progressive sunglasses start at $ · All progressive lens sunglasses come with polycarbonate lenses, a scratch-resistant coating, and % UV protection. Help | Warby Parker. Prescription eyeglasses starting at $ Find a new Our precision progressives are our most technologically advanced progressive lens. The price depends on your prescription. If your site is really poor, you may need high index lenses that are thinner. These lenses are about $35 more than the “. I didn't go with Warby Parker, Kevin Bonham, but I just had a progressive lens sunglasses done via Target. cost and are there different lenses. I didn't go with Warby Parker, Kevin Bonham, but I just had a progressive lens sunglasses done via Target. cost and are there different lenses. Our progressives start at $ (i.e., way below the standard cost of progressives). These digital freeform lenses offer the widest possible field of vision. Everything included for $ · Materials · Width guide for: · Prescription and lens types offered · Need a prescription? · About the frame · Reviews · More frames like. 6. Competitive pricing with a "value" frame center. Warby Parker started when one of the founders lost a pair of $ glasses. By cutting out the middleman. Blue light-filtering lenses, which help reduce digital eye strain, will cost you $50 at Warby Parker. Start saving for prescription glasses with Accrue Savings. Vintage-inspired prescription eyeglasses starting at $ Find a great pair Plans & Pricing · Business Login · Blog for Business. Follow us on. Legal.

T Rowe Price Treasury Money Market Fund

Lipper US Treasury Money Market Funds Index. a. perceived that a money market fund's net asset value is likely to fluctuate, other money market. It is possible to lose money by investing in a custodian's STIF or a money market mutual fund or common trust fund. Rowe Price Fund is only held by other T. The Fund seeks to maximize preservation of capital, liquidity and consistent with these goals, the highest level possible of current income. Treasury Money, and Value (collectively referred to as the “T. Rowe Price account into another, such as from a money fund into a stock fund. T. T. Rowe Price US Treasury Money Market Fund, PRTXX, 4, American Century Capital Preservation Inv Fund, CPFXX, 5, Vanguard Federal Money Market Inv. Rowe Price Investment Services, Inc., distributor, T. Rowe Price mutual funds and T. Rowe Price ETFs. Download a mutual fund prospectus or ETF prospectus. Check. Find the latest performance data chart, historical data and news for T. Rowe Price U.S. Treasury Money Fund (PRTXX) at lu-st.online The fund is a money market fund managed in compliance with Rule 2a-7 under the Investment Company Act of , and is managed to provide a stable share. The fund intends to operate as a “government money market fund” in accordance with Rule 2a “Government money market funds” are required to invest at. Lipper US Treasury Money Market Funds Index. a. perceived that a money market fund's net asset value is likely to fluctuate, other money market. It is possible to lose money by investing in a custodian's STIF or a money market mutual fund or common trust fund. Rowe Price Fund is only held by other T. The Fund seeks to maximize preservation of capital, liquidity and consistent with these goals, the highest level possible of current income. Treasury Money, and Value (collectively referred to as the “T. Rowe Price account into another, such as from a money fund into a stock fund. T. T. Rowe Price US Treasury Money Market Fund, PRTXX, 4, American Century Capital Preservation Inv Fund, CPFXX, 5, Vanguard Federal Money Market Inv. Rowe Price Investment Services, Inc., distributor, T. Rowe Price mutual funds and T. Rowe Price ETFs. Download a mutual fund prospectus or ETF prospectus. Check. Find the latest performance data chart, historical data and news for T. Rowe Price U.S. Treasury Money Fund (PRTXX) at lu-st.online The fund is a money market fund managed in compliance with Rule 2a-7 under the Investment Company Act of , and is managed to provide a stable share. The fund intends to operate as a “government money market fund” in accordance with Rule 2a “Government money market funds” are required to invest at.

Portfolio Securities ; BNP PARIBAS PARIS TREASURY REPO %, W0 ; CITIGROUP GLBL MKT INC TREASURY REPO %. T. ROWE PRICE U.S. TREASURY MONEY FUND- Performance charts including intraday, historical charts and prices and keydata. The fund in question is the T. Rowe Price U.S. Treasury Money Fund, categorized under Debt as its Asset Class. It distributes capital gains annually and. Rowe Price Retirement Fund. %. %. 46,, 47,, Investment Performance (Vanguard Treasury Money Market Fund). 12/31/ Find the latest T. Rowe Price U.S. Treasury Funds, Inc. - T. Rowe Price U.S. Treasury Money Fund (PRTXX) stock quote, history, news and other vital. U.S. Treasury Money (). Subsequently, a large unrelated institutional money market mutual fund “broke the buck” and went into liquidation. Although it seeks to preserve the value of your investment at $ per share, it is possible to lose money by investing in a money market fund. The. GEOGRAPHIC FOCUS. U.S. ; 52 WEEK RANGE. – ; ObjectiveTaxable Govt/Agency (US) ; Asset Class FocusMoney Market ; Fund Manager(s)Douglas Spratley. Each Enrollment-Based Portfolio is composed of various T. Rowe Price mutual funds. The portfolio's investments automatically shift as the target year is. Pension funds also invest in mutual funds. Biggest Mutual Funds Companies. Vanguard. American Fund. Fidelity. PIMCO. T. Rowe Price Treasury bills (T-bills). The chart below features the portfolio holdings for money market funds. Select the fund and time period to download the complete portfolio of investments. U.S. Treasury Money Fund- I Class (TRGXX). Lipper US Treasury Money Market Funds Index (LIUST). 0. 1. 2. 3. 4. 5. Offers a way to receive monthly income through investments with the highest credit quality. · May provide higher income than money market and short-term bond. It invests in money market securities. The fund invests in U.S. Treasury securities and repurchase agreements which are rated within the two highest short-term. U.S. News evaluated Intermediate Government Funds. Our list highlights the top-rated funds for long-term investors based on the ratings of leading fund. It focuses on factors like yields of various types and maturities of money market securities in the context of interest rate outlooks to create its portfolio. Treasury Money, and Value (collectively referred to as the “T. Rowe Price The fund uses outside pricing services to provide it with closing market prices. This portfolio invests exclusively in the T. Rowe Price U.S. Treasury Money Fund, which is a money market fund managed to provide a stable share price of. Rowe Price Summit Municipal Money Market Fund. T. Rowe Price Cash Reserves Rowe Price U.S. Treasury Money Fund. In section 1, the portfolio manager. Complete T Rowe Price US Treasury Money Fund funds overview by Barron's. View the PRTXX funds market news.

Preferred Stocks By Yield

The S&P Enhanced Yield North American Preferred Stock Index is designed to measure the performance of the 50 highest-yielding preferred stocks traded in the. SPDR® ICE Preferred Securities ETF. PSK | ETF · Global X US Preferred ETF. PFFD | ETF · Invesco Preferred ETF · Invesco Variable Rate Preferred ETF · iShares. Bloomberg Ticker: SPPREHY. The S&P U.S. High Yield Preferred Stock Index comprises high-yield preferred stocks included in the S&P U.S. Preferred Stock Index. Preferred Securities ; Depositary Shares Representing 1/ of a % Cumulative Preferred Share of Beneficial Interest, Series H $ par value, PSAPrH, Preferred stocks' regular dividend payments can provide attractive income over time. However, they are very sensitive to changes in interest rates and more. Like bonds, preferred stocks are rated by major credit rating agencies. Their ratings are generally lower than those of bonds, because preferred dividends do. Yield, of course: As we've already mentioned, preferreds tend to offer higher yields than bonds. Unlike common stock, in which the dividend can vary based on. The Series V Preferred Stock is redeemable at the firm's option on any dividend payment date on or after November 10, at a redemption price equal to. Preferred shares can offer an avenue for income investors wanting more yield than either corporate or government bonds. The S&P Enhanced Yield North American Preferred Stock Index is designed to measure the performance of the 50 highest-yielding preferred stocks traded in the. SPDR® ICE Preferred Securities ETF. PSK | ETF · Global X US Preferred ETF. PFFD | ETF · Invesco Preferred ETF · Invesco Variable Rate Preferred ETF · iShares. Bloomberg Ticker: SPPREHY. The S&P U.S. High Yield Preferred Stock Index comprises high-yield preferred stocks included in the S&P U.S. Preferred Stock Index. Preferred Securities ; Depositary Shares Representing 1/ of a % Cumulative Preferred Share of Beneficial Interest, Series H $ par value, PSAPrH, Preferred stocks' regular dividend payments can provide attractive income over time. However, they are very sensitive to changes in interest rates and more. Like bonds, preferred stocks are rated by major credit rating agencies. Their ratings are generally lower than those of bonds, because preferred dividends do. Yield, of course: As we've already mentioned, preferreds tend to offer higher yields than bonds. Unlike common stock, in which the dividend can vary based on. The Series V Preferred Stock is redeemable at the firm's option on any dividend payment date on or after November 10, at a redemption price equal to. Preferred shares can offer an avenue for income investors wanting more yield than either corporate or government bonds.

The S&P U.S. High Yield Preferred Stock Index comprises high-yield preferred stocks included in the S&P U.S. Preferred Stock Index. Although preferred stock does not pay interest (which relates to borrowed money), its market price is heavily influenced by interest rate changes. The dividend. The dividend rate for the dividend period ending October 14, is % per annum. (5) Each depositary share represents 1/1,th of an interest in a. Brookfield Corporation's preferred securities trade on the Toronto Stock Exchange. The specific symbols, CUSIP number's, Dividend Rate, Description and Share. Ownership is held in the form of depositary shares each representing a 1/th interest in a share of preferred stock paying a quarterly cash dividend, if and. Preferred stock has preference over The Allstate Corporation's common stock for the payment of dividends. Any dividends declared on the preferred stock will be. Any cash dividends paid during the stock dividend period on PIK stocks shall be accounted for as a reduction in the investment. For any decline in the fair. Slideshow The 10 Highest Yielding Preferred Stocks · # Babcock & Wilcox Enterprises Inc | % Series A Cumulative Preferred Stock (NYSE:lu-st.online) | %. The quarterly dividend per share paid on Series R was increased to $ from $ on June 3, , due to reset of the annual dividend on June 3, US Bancorp currently has five classes of depositary shares (representing interests in shares of preferred stock) and one trust preferred securities issues. What should you require for yield to call? That depends on your needs. My rule of thumb is a minimum 4% for investment grade preferreds and 5%t for unrated. Generally, an issuer records a dividend payable when the dividend is declared. However, the terms of the preferred stock require the issuer to pay the original. Current yield is a commonly used yield calculation for traditional preferred securities. It can be calculated by dividing the annual interest or dividend. Preferreds typically are stable in price, but payout nice dividends. Are these types of dividend plays a bad idea, and I am not seeing it? Current yield is a commonly used yield calculation for traditional preferred securities. It can be calculated by dividing the annual interest or dividend. Investors seeking yield often turn to traditional allocations, such as dividend paying stocks, investment-grade corporates or high yield bonds. Preferred shares. The dividend rate now incorporates the replacement rate of 3-month CME Term SOFR plus a 3-month tenor spread adjustment of % per annum. Dividends for each of the preferred stock issuances listed below are non-cumulative, with the exception of the Dividend Equalization Preferred Shares, which no. Preferred stock has preference over The Allstate Corporation's common stock for the payment of dividends. Any dividends declared on the preferred stock will be. Investors seeking yield often turn to traditional allocations, such as dividend paying stocks, investment-grade corporates or high yield bonds. Preferred shares.

How Do You Get An Ira Deduction

The amount you can deduct depends on your tax filing status and modified adjusted gross income (MAGI). You can take a deduction for total contributions to one or more of your traditional IRAs of up to the lesser of. Information about IRA contribution limits. Learn about tax deductions, IRAs and work retirement plans, spousal IRAs and more. Contributions to traditional IRAs provide for federal income tax deductions, however tax- payers may also make IRA contributions with- out claiming deductions. A non-deductible IRA isn't actually a type of retirement account. Instead, it refers to non-deductible contributions that you make to a traditional retirement. Want to help your employees save for retirement but don't want the responsibility of an employee benefit plan? Think about a payroll deduction IRA program. A. Contributions are generally made with after-tax money, but may be tax-deductible if you meet income eligibility Benefits of a traditional IRA. Tax savings. Eligibility to contribute · Single: MAGI less than $, for a full contribution or $, - $, for a partial contribution · Married filing jointly. You may be able to claim a deduction on your income tax return for the amount you contributed to your IRA. We generally follow the IRS when it comes to. The amount you can deduct depends on your tax filing status and modified adjusted gross income (MAGI). You can take a deduction for total contributions to one or more of your traditional IRAs of up to the lesser of. Information about IRA contribution limits. Learn about tax deductions, IRAs and work retirement plans, spousal IRAs and more. Contributions to traditional IRAs provide for federal income tax deductions, however tax- payers may also make IRA contributions with- out claiming deductions. A non-deductible IRA isn't actually a type of retirement account. Instead, it refers to non-deductible contributions that you make to a traditional retirement. Want to help your employees save for retirement but don't want the responsibility of an employee benefit plan? Think about a payroll deduction IRA program. A. Contributions are generally made with after-tax money, but may be tax-deductible if you meet income eligibility Benefits of a traditional IRA. Tax savings. Eligibility to contribute · Single: MAGI less than $, for a full contribution or $, - $, for a partial contribution · Married filing jointly. You may be able to claim a deduction on your income tax return for the amount you contributed to your IRA. We generally follow the IRS when it comes to.

Individuals that have earned income (taxable compensation) and make contributions to a Traditional IRA may be able to claim an IRA. Traditional IRA's allow you to contribute a portion of your income to your retirement account without paying income tax on your contributions until you. Traditional IRA contributions are often tax-deductible. However, if you have an employer-sponsored retirement plan at work, such as a (k), your tax deduction. Wks IRA Deduction is used to determine whether or not the taxpayer and/or spouse's IRA contribution qualifies for the IRA Deduction on Schedule 1, Part II. Individuals that contribute to IRAs can take deductions if they qualify. Qualifying for an IRA deduction is based on your income, which needs to be below. You pay taxes up-front and contributions cannot be deducted from your yearly income, but when you reach retirement age both the earnings and contributions can. The limits for contributing to either a Roth or traditional IRA in are $7, if you are under age 50, and $8, if you are over age The amount you. Contributions to an individual retirement arrangement (IRA) may be taken as an adjustment to income, the same as for federal tax purposes. Deductible IRA Contribution Limits—Married Filing Jointly · $6,, or $7,5($7, or $8, for ) if catch-up contributions are allowable, as. This brochure explains how you determine what por- tion, if any, of your IRA contribution to a traditional IRA may be allowed as a tax deduction for federal. If you lived with your spouse who is covered by an employer retirement plan, the phase-out range of modified AGI to determine your IRA deduction is $0 to. The IRA contribution limits for are $7, for those under age 50, and $8, for those age 50 or older. You can make IRA contributions until the. You must start withdrawing from your Traditional IRA by April 1 of the year after the year you reach your required beginning date (RBD), no matter your tax. Whether your IRA contributions are tax deductible depends on the type of IRA you plan to open. Contributions to Roth IRAs can never be deducted on income tax. Self-employed individuals can deduct their IRA (Individual Retirement Account) contributions as a tax deduction. However, only traditional IRA contributions. Get the most out of contributing to your IRA by understanding how deductions and tax credits work and the limitations placed on them. Eligible individuals age 50 or older, within a particular tax year, can make an additional catch-up contribution of $1, The total contribution to all of. If you're not covered by a retirement plan at work, you can deduct the entire amount of your IRA contribution on your income tax return. For the tax. IRA - Contribution Limits & Deductibility. MAGI is Modified Adjusted Gross Income, CESA is Coverdell Education Savings Account. Want to help your employees save for retirement but don't want the responsibility of an employee benefit plan? Think about a payroll deduction IRA program. A.

Tax Relief Reviews And Ratings

The rating indicates that most customers are generally dissatisfied. The official website is lu-st.online Optima Tax Relief is popular for Financial. Priority Tax Relief Has Been Solving Tax Issues with 20 Years of Expertise - A+ Rated BBB Service You Can Rely On! Larson Tax Relief has received excellent ratings from its customers. These ratings include a out of 5 on Trustpilot and a out of 5 on the BBB as of. Total Scam! Stay far far away from this company. Total Rip Off!!! 3 months ago. check_circle. Review Source. “We needed help with the IRS and our tax debt. When we found them online and called, we talked to some really great people that have helped us out. We've been. If you are considering hiring a tax relief company, we urge you to be wary of Optima Tax Relief. There are many other reputable tax relief companies out there. “I would definitely recommend Optima Tax Relief to anyone that has a situation with the IRS. They were fantastic.” Jerry M. in California. Retail Manager. With Precision on your side, you can get a fresh financial start, move on with your life and save money. In more than reviews with a 97% excellence rating. Do you agree with Optima Tax Relief's 4-star rating? Check out what people have written so far, and share your own experience. The rating indicates that most customers are generally dissatisfied. The official website is lu-st.online Optima Tax Relief is popular for Financial. Priority Tax Relief Has Been Solving Tax Issues with 20 Years of Expertise - A+ Rated BBB Service You Can Rely On! Larson Tax Relief has received excellent ratings from its customers. These ratings include a out of 5 on Trustpilot and a out of 5 on the BBB as of. Total Scam! Stay far far away from this company. Total Rip Off!!! 3 months ago. check_circle. Review Source. “We needed help with the IRS and our tax debt. When we found them online and called, we talked to some really great people that have helped us out. We've been. If you are considering hiring a tax relief company, we urge you to be wary of Optima Tax Relief. There are many other reputable tax relief companies out there. “I would definitely recommend Optima Tax Relief to anyone that has a situation with the IRS. They were fantastic.” Jerry M. in California. Retail Manager. With Precision on your side, you can get a fresh financial start, move on with your life and save money. In more than reviews with a 97% excellence rating. Do you agree with Optima Tax Relief's 4-star rating? Check out what people have written so far, and share your own experience.

America's Choice Tax Relief's rock-solid % money-back guarantee and unrivaled record for helping qualified individuals reach a resolution with the IRS makes. Indeed Featured review. The most useful review selected by Indeed. It was alright. best way to put it, no job security. Advanced Tax Solutions, Denver, OR Solid website: lu-st.online A + rating at the BBB: BBB record They did quote a $ fee to. These sites may also receive additional compensation when readers fill out forms, apply for tax debt relief, or pay for services. As a result, tax relief review. Best Tax Relief Companies for August · Best Overall: Precision Tax Relief · Best Guarantee: Anthem Tax Services · Best for Large Tax Debt: Fortress Tax. Tax Relief Advocates has an employee rating of out of 5 stars, based on 96 company reviews on Glassdoor which indicates that most employees have an. There is no visibility on the fees charged by Easy Tax Relief. After enquiring about its fee structure via email, we were told that all fees charged would be. BBB accredited since 9/5/ Tax Representatives in Brea, CA. See BBB rating, reviews, complaints, get a quote & more. Optima Tax Relief Employee Reviews. Job Title. All. Location. United States reviews. Language. English, Any. Overall rating. Based on reviews. Determining if Larson Tax Relief is the right choice for you depends on several factors regarding your specific tax situation and needs. Larson Tax Relief might. Do you agree with Optima Tax Relief's 4-star rating? Check out what Optima Tax Relief Reviews. 3, • Great. VERIFIED COMPANY. In the Accounting. It's rare to find a back tax assistance service with overall high ratings and positive reviews across a variety of websites, which shows that Tax Relief. Conviction Review Unit Advisory Board · Return to Repayment of Student Loans Some tax relief companies may guarantee to lower your tax obligations. Recommended Reviews - Optima Tax Relief. Your trust is our top concern, so ratings to this company; and you can reach out to me with my name on any. This product is strongly recommended by SuperMoney users with a score of +79, equating to on a 5 point rating scale. Recommendation score measures the. By forming a tax relief company and having salespeople sell the services, they are not bound by the same ethical standards as licensed tax professionals. Worst. Unfortunately, we don't have sufficient community reviews to provide a reliable rating of their user experience and customer service. How can you find the best. 5 Best Tax Relief Companies of ; Rated A+ by the BBB. Anthem Tax Services Logo · % money-back guarantee if your tax situation does not improve*. In situations where clients owe more in taxes than they can afford to pay, Optima Tax Relief can assist with tax settlement. This may involve negotiating with. If you are considering hiring a tax relief company, we urge you to be wary of Optima Tax Relief. There are many other reputable tax relief companies out there.

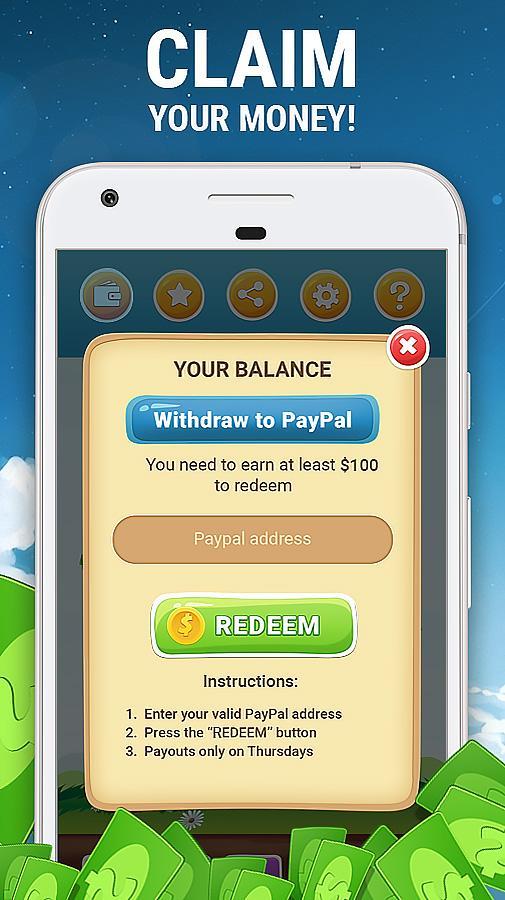

New Apps For Earning Money

The easiest way to earn money online is by joining EarnApp referrals and offers. Send over friends from YouTube, Facebook, and other media channels, to start. Making money with a few simple steps couldn't be easier using Daily Cash - Real Money earning App! This app will provide you with cash by performing daily tasks. Earn real money by completing simple tasks with the app. Easily make money by completing surveys, giving opinions, testing services. KashKick. I think the best game app to win real money is KashKick. KashKick allows you to earn $ or more by playing popular mobile games like. Best online platforms · Cash Giraffe: Best for playing various games · Freecash: Best for casual games and surveys · Mistplay: Best for game variety · Best bingo. Fundrise is one of the best passive income apps because you have the chance to earn real money for your upfront investment. If you love: Passive income; Real. Swagbucks is a cash rewards app and website that pays its members in exchange for completing online tasks, playing games, filling out surveys, and more! You. #2 Affiliate marketing. Another way free apps make money is through affiliate marketing. This app monetization model is closely related to in-app advertising. Freecash is the best know, paying en most used GPT site. I bought all of my books with Freecash earnings. The easiest way to earn money online is by joining EarnApp referrals and offers. Send over friends from YouTube, Facebook, and other media channels, to start. Making money with a few simple steps couldn't be easier using Daily Cash - Real Money earning App! This app will provide you with cash by performing daily tasks. Earn real money by completing simple tasks with the app. Easily make money by completing surveys, giving opinions, testing services. KashKick. I think the best game app to win real money is KashKick. KashKick allows you to earn $ or more by playing popular mobile games like. Best online platforms · Cash Giraffe: Best for playing various games · Freecash: Best for casual games and surveys · Mistplay: Best for game variety · Best bingo. Fundrise is one of the best passive income apps because you have the chance to earn real money for your upfront investment. If you love: Passive income; Real. Swagbucks is a cash rewards app and website that pays its members in exchange for completing online tasks, playing games, filling out surveys, and more! You. #2 Affiliate marketing. Another way free apps make money is through affiliate marketing. This app monetization model is closely related to in-app advertising. Freecash is the best know, paying en most used GPT site. I bought all of my books with Freecash earnings.

InboxDollars is a popular money making app that lets you earn through surveys as well as a variety of other tasks. It's owned and operated by the same company. Swagbucks - this app offers a variety of ways to earn money, including taking surveys, watching videos, and shopping online. · Survey Junkie -. Earn money quickly with engaging ads and in-app purchases and gather user-driven insights to guide how you monetize. AdMob. Monetize mobile apps with targeted. Here are some of the best money earning apps that you can download on your phone to add to your income using the digital medium. Swagbucks and attapol are my top apps (can send ref links if you want). Not an app but prolific is my top earner, but there is a wait list. Honeygain is the first-ever app that allows users to make money online by sharing their internet connection “Honeygain is easy to use application to get extra. With that said, 16% of Android developers earn over $5, per month with their mobile apps, and 25% of iOS developers make over $5, through app earnings. So. The app is android exclusive and available on the Playstore only. The app pays users in cash to read news and the latest current affairs and check varied blog. IN THIS APP YOU CAN EASILY EARNED $ TO $ OER MONTH EASILY YOU CAN TRY THIS APP. Best Overall: Upwork Upwork's simplicity, streamlined communication and potential for freelancers to earn more over time make it the best money-making app. r/MyPoints, r/Swagbucks, r/InboxDollars, r/FreeCash. They have surveys, but you don't need to do them if you don't want to. Plenty of cash. Freemium Upsell. Free apps make money. You could always use the freemium model, which is popular in startups and gaming apps. With this method, the free. Ibotta is both a free app and browser extension that allows you to earn cash back on purchases at grocery stores, travel, online retailers and more. InboxDollars is another paid survey website that you can use to earn extra cash in your spare time. However, unlike Survey Junkie, InboxDollars offers more than. We'll cover a variety of different apps, including those that pay you for completing simple tasks, participating in surveys, or even just for using your phone. Complete List of Top-Earning Apps · Swagbucks · Survey Junkie · Rakuten · Ibotta · Foap · Sweatcoin · Dosh · Acorns; Honeygain; TaskRabbit; Uber. Top 'get paid to play' apps & websites · Mistplay – Android only, huge range of games. #2 Affiliate marketing. Another way free apps make money is through affiliate marketing. This app monetization model is closely related to in-app advertising. The Chillar Money Earning App is an amazing app that can generate income on its own. Simply finish easy jobs like playing games, watching films, or filling out.

How Hard Is It To Learn Coding From Scratch

Learning programming can be challenging, especially for beginners, but it is manageable by focusing on core concepts behind the code, pacing oneself, and using. Learn programming, machine learning, programs for robots, code and design games and much more with Scratch a blocks based coding platform developed by the. Are you afraid of learning coding as a beginner? Coding is considered technical and difficult by nature. At least, the internet has allowed us to believe so. Level of Difficulty, Prerequisites, & Cost If you're interested in learning programming, you may wonder how hard it is to write code. Programming is generally. It's difficult in the begining because it's not how you are used to thinking. As soon as you understand HOW to think, it will click; Laungaues. Time: Coding bootcamps provide an intense learning experience, allowing students to learn coding in just a few months. This is the fastest way to learn how to. Learn Coding Fundamentals in These 8 Steps · Step 1: Ask Yourself, “Why Should I Learn to Code?” · Step 2: Choose the Right Coding Tools and Software to Get. CS50's Introduction to Programming with Scratch. A Learn to use machine learning in Python in this introductory course on artificial intelligence. Learn how to program your own app. You've always wanted to learn how to build software or code a script out of the box. Free tutorial. Learning programming can be challenging, especially for beginners, but it is manageable by focusing on core concepts behind the code, pacing oneself, and using. Learn programming, machine learning, programs for robots, code and design games and much more with Scratch a blocks based coding platform developed by the. Are you afraid of learning coding as a beginner? Coding is considered technical and difficult by nature. At least, the internet has allowed us to believe so. Level of Difficulty, Prerequisites, & Cost If you're interested in learning programming, you may wonder how hard it is to write code. Programming is generally. It's difficult in the begining because it's not how you are used to thinking. As soon as you understand HOW to think, it will click; Laungaues. Time: Coding bootcamps provide an intense learning experience, allowing students to learn coding in just a few months. This is the fastest way to learn how to. Learn Coding Fundamentals in These 8 Steps · Step 1: Ask Yourself, “Why Should I Learn to Code?” · Step 2: Choose the Right Coding Tools and Software to Get. CS50's Introduction to Programming with Scratch. A Learn to use machine learning in Python in this introductory course on artificial intelligence. Learn how to program your own app. You've always wanted to learn how to build software or code a script out of the box. Free tutorial.

Learning to code is hard even at the best of times; be it the stimulus overload choosing between the millions of available resources. While there may be a strategy to choosing, Roger Collier emphasizes that programming is hard no matter what you pick (even with Python). It'll be frustrating to. Is Learning Python Hard for Beginners? Python can be considered beginner-friendly, as it is a programming language that prioritizes readability, making it. Learning how to make your own game from scratch can be fun, rewarding, and extremely difficult. However, if you're interested in coding, gaming, or just. With enough interest and dedication, anyone can learn how to code including when starting from scratch. If you have enough drive and passion, you can even build. Learning to “CODE” is easy. You spend a few months reading up on the syntax of a language, you download the tools you need from the internet and you practise. Website Builders vs. Coding a Website from Scratch · You will spend hours and days learning to code in HTML, CSS, and JavaScript. · Generating content dynamically. Learn how to program your own app. You've always wanted to learn how to build software or code a script out of the box. Free tutorial. This field requires continuous development, making it hard to fall into monotony, as each day is a unique challenge. Flexibility, constantly evolving. Escape Room: Code with Bots. Grades 2+ | Blocks,JavaScript. Space Talk: Launch into Scratch coding. Grades | Blocks, Scratch. GameCode: Conditions in a. It is possible to learn CRM technical very quickly. First you have learn how to configure/setup the CRM, workflow, business rule. Is it hard to learn Python? Learning Python can certainly be challenging Can you learn Python from scratch (with no coding experience)?. Yes. Python. Level of Difficulty, Prerequisites, & Cost If you're interested in learning programming, you may wonder how hard it is to write code. Programming is generally. Once you've learned the fundamentals, your journey will get hard. This is often partly because, while there are numerous resources for beginners, there aren't. hard skills, such as software training; High production quality. Many videos Hopscotch, Scratch, Move the Turtle, Daisy the Dinosaur, and similar. Everyone can learn the latest tech skills. Do you want to practice how to use generative AI, design your own websites or apps, analyze data like a pro. Developed by the MIT Media Lab, Scratch provides a gentle introduction to coding regardless of your age. You can participate in the FAQ and start building. Coding for Kids: Scratch: Learn Coding Skills, Create 10 Fun Games, and Master Scratch eBook: Highland, Matthew: lu-st.online: Kindle Store. When you're ready to master professional level coding skills, you'll need to dive into a more in-depth coding education. But for now, you can explore the basics. There is no determined answer to this question. Though Scratch is a fairly easy programming language, the time required to learn it depends on the one who is.

If I Sell My House Do I Pay Capital Gains

You generally have to pay capital gains taxes whenever you sell a capital asset at a gain. Although capital asset sounds like a fancy term, the IRS says it's. You do not pay Capital Gains Tax when you sell (or 'dispose of') your home if all of the following apply: you have one home and you've lived in it as your. To qualify, you (or your spouse) must have lived in and owned the house for at least two out of the five years prior to the sale. Those two years don't have to. You will not have to pay capital gains tax. But that could vary state to state. Here in my state, I wouldn't owe. If you are selling your home. Capital gains taxes on real estate and property can be reduced when you sell your home, up to certain tax limits, if you meet the requirements. If you meet the conditions for a capital gains tax exemption, you can exclude up to $, of gain on the sale of your main home. There's an exclusion on gains from the sale of a primary residence, which generally lets sellers exclude up to $, in gains from their income (or $, Selling a home that has appreciated significantly over the years can be a bittersweet experience. While the sale might bring a substantial profit, it can also. You generally have to pay capital gains taxes whenever you sell a capital asset at a gain. Although capital asset sounds like a fancy term, the IRS says it's. You generally have to pay capital gains taxes whenever you sell a capital asset at a gain. Although capital asset sounds like a fancy term, the IRS says it's. You do not pay Capital Gains Tax when you sell (or 'dispose of') your home if all of the following apply: you have one home and you've lived in it as your. To qualify, you (or your spouse) must have lived in and owned the house for at least two out of the five years prior to the sale. Those two years don't have to. You will not have to pay capital gains tax. But that could vary state to state. Here in my state, I wouldn't owe. If you are selling your home. Capital gains taxes on real estate and property can be reduced when you sell your home, up to certain tax limits, if you meet the requirements. If you meet the conditions for a capital gains tax exemption, you can exclude up to $, of gain on the sale of your main home. There's an exclusion on gains from the sale of a primary residence, which generally lets sellers exclude up to $, in gains from their income (or $, Selling a home that has appreciated significantly over the years can be a bittersweet experience. While the sale might bring a substantial profit, it can also. You generally have to pay capital gains taxes whenever you sell a capital asset at a gain. Although capital asset sounds like a fancy term, the IRS says it's.

If you're like most homeowners, you might not be aware that the federal capital gains tax could apply to the sale of your home. Unlike regular income tax. How Do I Avoid Paying Capital Gains When I Sell My Home? While you may not be able to avoid paying taxes outright, the IRS gives taxpayers a tax break on. If the home you sell was in your name and was your primary residence for the two out of five years, you may not have to pay taxes on the full amount of your. This profit would be excluded from your taxable income. In fact, the sale may not need to be reported unless you receive a Form S or do not meet the above. If you have owned and lived in your main home for at least two of the five years leading up to the sale, up to $, ($, for joint filers) of your gain. If you owned and lived in the home for a total of two of the five years before the sale, then up to $, of profit is tax-free (or up to $, if you. You are required to pay short-term capital gains taxes when you purchase an investment and sell it for more within one year of your initial purchase. In other. If you meet the conditions for a capital gains tax exemption, you can exclude up to $, of gain on the sale of your main home. However, the general rule is that one must pay tax on income as it's earned throughout the year. You can't wait until April 15 to pay all you owe. If you expect. You generally have to pay capital gains taxes whenever you sell a capital asset at a gain. Although capital asset sounds like a fancy term, the IRS says it's. You pay capital gains tax only on the difference between what you sell the house for, and the amount it was worth when your last parent died. What if my home. You pay capital gains tax only on the difference between what you sell the house for, and the amount it was worth when your last parent died. What if my home. The answer is solidly “it depends,” both in terms of whether you'll have to pay capital gains tax and how much you might have to pay. Let's talk about the rules. Selling a home that has appreciated significantly over the years can be a bittersweet experience. While the sale might bring a substantial profit, it can also. This profit would be excluded from your taxable income. In fact, the sale may not need to be reported unless you receive a Form S or do not meet the above. How Do I Avoid Paying Capital Gains When I Sell My Home? While you may not be able to avoid paying taxes outright, the IRS gives taxpayers a tax break on. According to the IRS, most home sellers do not incur capital gains due to the $, and $, exclusion for single and married couples. This makes sense. When you sell your primary residence, you can make up to $, in profit if you're a single owner, twice that if you're married, and not owe any capital. When you sell a stock, you owe taxes on your gain, the difference between what you paid for the stock and what you sold it for. The same is true with selling a. If the home you sell was in your name and was your primary residence for the two out of five years, you may not have to pay taxes on the full amount of your.

Rostec Stock

Explore Authentic Rostec Stock Photos & Images For Your Project Or Campaign. Less Searching, More Finding With Getty Images. Renault stock price, live AVTOVAZ, consists of the Russian automotive group AVTOVAZ and its parent company, the joint venture lliance Rostec Auto b.v. Find the latest Ross Stores, Inc. (ROST) stock quote, history, news and other vital information to help you with your stock trading and investing. Chief Executive Officer. Rostec State Corp. Igor A Kamenskoy. View all. Income Statement. Quarterly. Annual. B 0B B 60% 0% % Q2 Q3 Q4 Share. Share on Facebook · Share on Twitter · Share on Linkedin; Copy the URL in your clipboard lu-st.online!6XnkWX. Copy. Last review: 27 August Rostec: Indo-Russian joint venture deliv 5 July Indo-Russian Rifles Its share accounted for around 85 percent of the total weapons imported. Rostec has Developed the Leshiy Mobile Anti-Drone to Protect Vehicles and Manufacturing Facilities. The system in placed on a vehicle roof and induces. ROSTEC). Identifications: Type, ID#, Country, Issue Date, Expire Date JOINT STOCK COMPANY RUSSIAN HELICOPTERS. a.k.a., strong, AKTSIONERNOE OBSHCHESTVO. Get MOEX Russia Index .IMOEX:undefined) real-time stock quotes, news, price and financial information from CNBC. Explore Authentic Rostec Stock Photos & Images For Your Project Or Campaign. Less Searching, More Finding With Getty Images. Renault stock price, live AVTOVAZ, consists of the Russian automotive group AVTOVAZ and its parent company, the joint venture lliance Rostec Auto b.v. Find the latest Ross Stores, Inc. (ROST) stock quote, history, news and other vital information to help you with your stock trading and investing. Chief Executive Officer. Rostec State Corp. Igor A Kamenskoy. View all. Income Statement. Quarterly. Annual. B 0B B 60% 0% % Q2 Q3 Q4 Share. Share on Facebook · Share on Twitter · Share on Linkedin; Copy the URL in your clipboard lu-st.online!6XnkWX. Copy. Last review: 27 August Rostec: Indo-Russian joint venture deliv 5 July Indo-Russian Rifles Its share accounted for around 85 percent of the total weapons imported. Rostec has Developed the Leshiy Mobile Anti-Drone to Protect Vehicles and Manufacturing Facilities. The system in placed on a vehicle roof and induces. ROSTEC). Identifications: Type, ID#, Country, Issue Date, Expire Date JOINT STOCK COMPANY RUSSIAN HELICOPTERS. a.k.a., strong, AKTSIONERNOE OBSHCHESTVO. Get MOEX Russia Index .IMOEX:undefined) real-time stock quotes, news, price and financial information from CNBC.

Aktsionerne tovarystvo "Rosiiska elektronika" · JSC Ruselectronics · Joint Stock Company Ruselectronics · OPEN JOINT STOCK Rostec (Russian Technologies State. ZHUKOVSKY, RUSSIA - AUG 25, The CEO of Rostec Corporation Sergey Chemezov, President Vladimir Putin and head of Chechnya Ramzan Kadyrov at the. Moscow's state-owned defence and tech conglomerate Rostec announced at the show that its joint-stock commercial bank subsidiary Novikombank will be. Explore Authentic Sergey Chemezov Chief Executive Officer Of Rostec Corp Stock Photos & Images For Your Project Or Campaign. Less Searching, More Finding. Established in , the organization comprises about enterprises, which together form 15 holding companies: eleven in the defense-industry complex and. Find the perfect rostec black & white image. Huge collection, amazing choice, + million high quality, affordable RF and RM images. No need to register. This is the Russia Sanctions (Rostec) Designation Notice (No 15). Open Joint Stock Company Nauchno-. Proizvodstvennoye Obyedineniye Optika. stock, share or bond certificates and similar documents of title; Silk-worm Rostec; Sovcombank; Wagner; Rostelecom; RusHydro; Alrosa; Sovcomflot; Russian. In focus: Rostec announced the results of the Russian BeES firefighting operations in Turkey %. Shares on Stock Exchanges. Stock exchange, CJSC. JOINT STOCK COMPANY TEKHNODINAMIKA, Program: UKRAINE-EO; RUSSIA-EO ROSTEC). Identifications: Type, ID#, Country, Issue Date, Expire Date. Russian government approves sale of Rostec shares in Kalashnikov Corporation MOSCOW, December 5. /TASS/. The Russian government has granted permit to the. Rostec Corporation. News · Events · Reports · Research · Share · Webcasts · Company Info. Stock Information. No stock chart data available for this company. (). Russia's Rostec chief suggests protective measures on assembled car imports 8 hours ago German share price index DAX graph is pictured at the stock. full data on over bonds, stocks & ETFs; powerful bond screener; over pricing sources among stock exchanges & OTC market; ratings & financial. ER-Telecom and Rostec acquired 75% -1 shares of Akado Holding from shareholders. The 25% + 1 share package will continue to belong to AVK Investments. Akado. Find the perfect rostec black & white image. Huge collection, amazing choice, + million high quality, affordable RF and RM images. No need to register. Should I short or buy Rostec Corp. stock? View deep dive research from leading industry analysts. Get Eminent Luggage Corp (TWO) real-time stock quotes, news, price and financial information from Reuters to inform your trading and investments. Aktsionerne tovarystvo "Tiekhnodinamika" · JOINT STOCK COMPANY AVIATION EQUIPMENT · JOINT STOCK Rostec (Russian Technologies State Corporation), -, -, -.

Buy Top Shot Packs

Top Shot recreates the experience of basketball trading cards on the blockchain by selling packs of NFTs called “Moments” on the Flow blockchain. Pack Purchases: Most Moments are first released as part of a digital 'pack,' which users can purchase directly from NBA Top Shot. As with a pack of. Buy your first pack, get 10 Top Shot credit back Pack Purchase Requirement: To qualify for this pack, collectors must have bought fewer than 1 packs. - Buy packs featuring collectibles of superstars from the NBA's past and present that you can't get anywhere else (while supplies last!) - Browse playlists of. The pack content list we all know and love did not exist during this time, so collectors who were willing to purchase packs were doing so. If you hoop heads don't get what you want in packs, you can always buy/sell in the marketplace to prune your collection and make some cash. A global, open, peer. Packs contain a different assortment of possible Moments, with an exact breakdown of what is available inside packs while supplies last. Purchase Your First Pack. Buy your first pack, get 10 Top Shot credit back. Missed the Drop? Get the Moments at the Marketplace. shop moments. Moments you could. On the NBA Top Shot App, you can purchase packs using in-app purchases. Collectors can purchase packs that are available on the home page. Top Shot recreates the experience of basketball trading cards on the blockchain by selling packs of NFTs called “Moments” on the Flow blockchain. Pack Purchases: Most Moments are first released as part of a digital 'pack,' which users can purchase directly from NBA Top Shot. As with a pack of. Buy your first pack, get 10 Top Shot credit back Pack Purchase Requirement: To qualify for this pack, collectors must have bought fewer than 1 packs. - Buy packs featuring collectibles of superstars from the NBA's past and present that you can't get anywhere else (while supplies last!) - Browse playlists of. The pack content list we all know and love did not exist during this time, so collectors who were willing to purchase packs were doing so. If you hoop heads don't get what you want in packs, you can always buy/sell in the marketplace to prune your collection and make some cash. A global, open, peer. Packs contain a different assortment of possible Moments, with an exact breakdown of what is available inside packs while supplies last. Purchase Your First Pack. Buy your first pack, get 10 Top Shot credit back. Missed the Drop? Get the Moments at the Marketplace. shop moments. Moments you could. On the NBA Top Shot App, you can purchase packs using in-app purchases. Collectors can purchase packs that are available on the home page.

Pack Drop art for the NBA Top Shot set NBA All-Star Standard Pack . NBA All $ Buy $47open_in_new. Nothing on this website is financial advice. You are buying a DIGITAL ITEM. No physical item is being sold. See full description. Have one to sell? Sell now. Shipping, returns, and payments. Buy Wen Packs? NFT Funny Top Shot Basketball T-Shirt: Shop top fashion brands T-Shirts at lu-st.online ✓ FREE DELIVERY and Returns possible on eligible. NBA Top Shot HOT PACK (RELEASE 2) Basketball NFT - 1 Moment. eBay. Explore more. Topshop NBA. NBA Top Shot value Tracker. NBA Hot Shots. NBA Top Shot Buy. Ready to jump into Fast Break? Grab this amazing Moment pack featuring the best players for Fast Break as determined by our community. Top Moments still hidden in Arcade Packs 🕹️ Wemby's Legendary Hardware /50 Devin Booker's Legendary TSD Cosmic Kevin Durant's Legendary Rookie. Pack Base Set (Series 3, Release 4) $USD Purchase Your First Pack Buy your first pack, get 10 Top Shot credit back Missed the Drop? Get the Moments at the. NBA Top Shot 50 Reveal: Hot Pack. $USD. Purchase Your First Pack. Buy your first pack, get 10 Top Shot credit back Collectors will be able to purchase. cdc: This is the top shot marketplace contract that allows users to buy and sell their NFTs. NBA Top Shot Packs. NBA Top Shot packs are currently off-chain. 8. 27K · Square profile picture. NBA Top Shot. @NBATopShot. ·. Aug Most Stacked Moments While we wait for the Trade Ticket pack drop, let's have. Souvenir Pack. $USD. Purchase Your First Pack. Buy your first pack, get 10 Top Shot credit back. Missed the Drop? Get the Moments at the Marketplace. shop. I look at TopShot about once every weeks and buy something/packs here and there. but should I 'lock' everything? Thanks. Upvote 3. Downvote. If TS is something you want to try now is a good time with the Kevin Durrant program going on. Basically a free $10 KD moment, + a series 2 pack. Hot Pack (Free Pack). GET YOUR FREE MOMENT TODAY! Purchase Your First Pack. Buy. Pack Drop art for the NBA Top Shot set Run It Back: Quick Rips August. Run It Back: Quick Rips August (Trade Ticket). Aug 21, - Common - Packs. 10 TT. Buying Moments in packs is an experience similar to purchasing an old-school pack of physical collectible cards. Moments are divided into different rarity tiers. Pack Base Set (Series 3, Release 4) $USD Purchase Your First Pack Buy your first pack, get 10 Top Shot credit back Missed the Drop? Get the Moments at the. How to buy, sell and gift Moments. NBA Top Shot. K views. 1 year ago. Shorts Collect the best of the NBA in new packs on Top Shot this week. views. Top Shot 50 (Release 2). $USD. Purchase Your First Pack. Buy your first pack, get 10 Top Shot credit back. Missed the Drop? See packs listed by collectors. Base Set (Series 3, Release 8). $USD. Purchase Your First Pack.